Gold-backed cryptocurrencies combine the digital nature of crypto with the stability and growth potential of gold. To summarize, the value of these stablecoins is supported by physical gold reserves.

So, as long as gold doesn’t crash overnight — which is very unlikely — your investment in these crypto assets will stay safe as well.

Plus, unlike fiat-backed cryptocurrencies like USDT, the price of some gold-backed coins fluctuates with global gold prices. This gives you a chance to capitalize on these market movements and make considerable profits.

The only hurdle standing between you and owning “digital gold” is choosing the right gold-backed crypto asset. Keep reading to learn about the ones that I personally recommend and how you can evaluate these assets on your own.

Top 5 Best Gold-Backed Cryptocurrencies

After going through most gold-backed cryptocurrencies on the market, I managed to narrow down my list to the top five assets worth your consideration. These are:

#1. Paxos Gold (PAXG)

Out of all the crypto assets I looked at for this review, Paxos Gold came out on top. The reason for this comes down to two factors.

First off, PAXG is the most popular and largest gold-backed cryptocurrency on the market. At the time of writing it boasts an impressive market cap of over 517 million USD with 263,000+ PAXG coins in circulation. This gives PAXG unmatched liquidity — making it easier to trade it efficiently.

The second reason I put Paxos Gold in the number one spot is that it can be redeemed for actual gold. Yes, you read that correctly. If you own PAXG tokens, you can trade them for physical gold bars with Paxos. Corporations can even redeem their tokens for the USD value of the underlying gold.

Another aspect of PAXG that I highly appreciate is its regulatory compliance. The physical gold that backs PAXG is stored in LBMA-certified vaults for safekeeping. It is also audited monthly to ensure the legitimacy of all the PAXG tokens in circulation.

Ratio with reserved gold

From what I’ve seen, PAXG is pegged 1:1 to a fine troy ounce of gold.

#2. Tether Gold (XAUT)

Issued by the name behind the third most popular crypto asset on the planet, Tether Gold is one of the most trustworthy options on my list.

It entered the market fairly recently in 2020 and has since become the second-largest gold-backed crypto asset. At the time of writing, XAUT has a market cap of more than 479 million USD with a 24-hour trading volume of over 4 million USD.

One of the biggest advantages of going with Tether Gold for me is its security. All of the reserve gold backing these tokens is stored in a Swiss vault. Each gold bar also has a unique identifier number assigned to it which you can look up from Tether’s website. Plus, similar to PAXG, XAUT can also be redeemed for physical gold bars.

One thing that the trader inside me absolutely loves about XAUT is that it can be divided as small as 0.000001 of a token. This fine division allows me and many other traders to take advantage of micro-movements in XAUT’s price and earn a profit.

Ratio with reserved gold

XAUT is also pegged 1:1 to a fine troy ounce of gold.

#3. Digix Global (DGX)

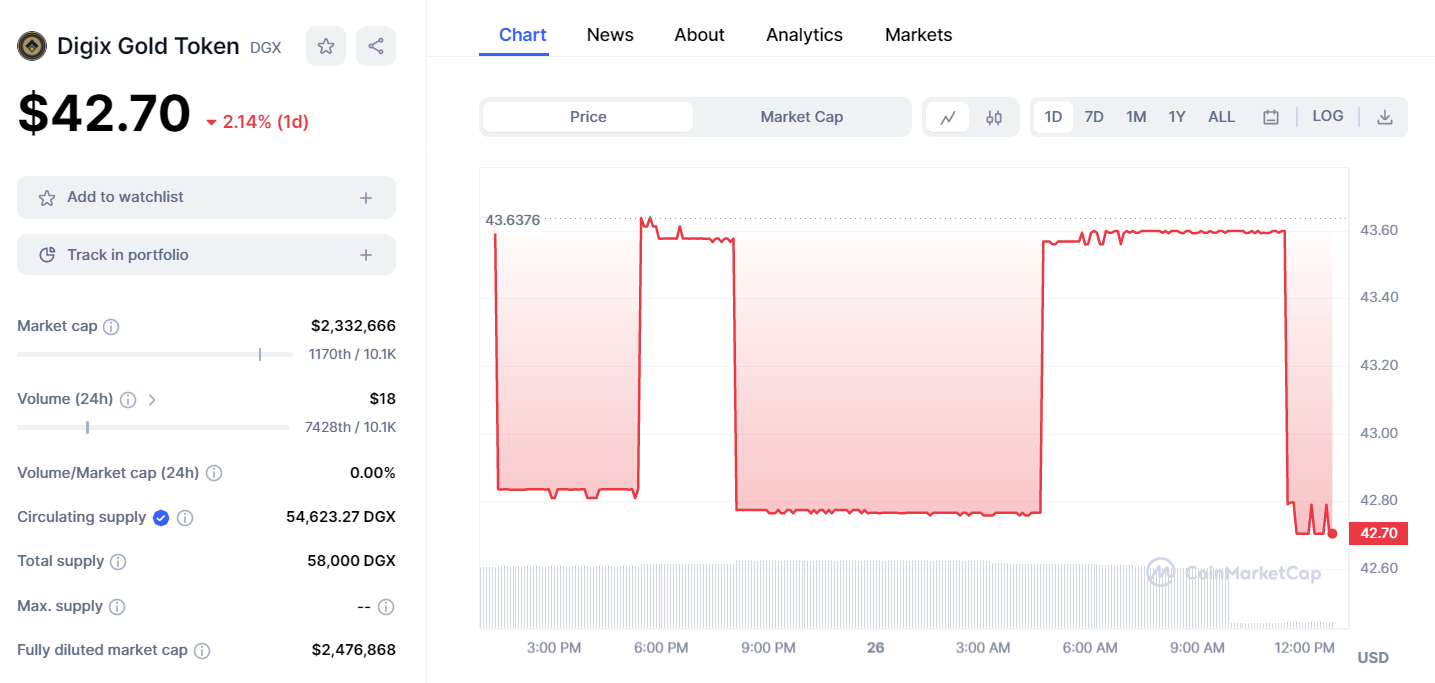

With a humble market cap of 2.3 million USD, Digix Global crypto asset is nowhere near as popular as my first two choices. So, why did it earn the #3 spot on my list? Mainly because of its unique ratio to the gold reserves.

Digix Global (DGX) - Price

In essence, one DGX token is backed by 1 gram of gold which is stored in bars of 100 grams each. This smaller ratio gives DGX a much more manageable price tag which — as a part of the retail trading group — I highly appreciate.

If you’re interested in building a large portfolio of gold-backed crypto assets over time, I’d recommend considering DGX as your first option. With its lower price, you can keep purchasing one or two DGX tokens every month and you’ll have a sizable collection in no time.

Ratio with reserved gold

Digix Global is pegged 1:1 to one gram of gold — a much smaller amount than my top two choices.

#4. Perth Mint Gold Token (PMGT)

Out of all the gold-backed cryptocurrencies I evaluated when making this list, Perth Mint Gold Token stands out as one of the more trustworthy ones.

This is because the reserve gold for this token is stored in the Perth Mint’s central bank — ensuring complete security. However, the most impressive part for me is the fact that this reserved gold is guaranteed by the Government of Western Australia.

Plus, every single PMGT token is completely liquid. In other words, you can redeem it for actual gold or fiat in equal amounts at any time. This way, you don’t have to worry about trading it with some other crypto owner.

PMGT is also highly stable, dare I say the most stable gold-backed crypto assets on my list. This makes it an excellent choice for anyone who wants a hassle-free way of storing their investment without having to worry about the volatility of the crypto market.

Ratio with reserved gold

PMGT is linked 1:1 to a 1-ounce GoldPass certificate. This certificate is then pegged 1:1 to one ounce of pure physical gold.

#5. Meld Gold (MCAU)

The thing that makes Meld Goal an exciting prospect for me is its hybrid approach to digitizing gold transactions. In essence, the Meld Gold company plans on dealing with both digital and physical gold — building a convenient on/off ramp for their gold-backed token; MCAU.

The company behind MCAU also markets their token as more of a digital stand-in for gold, instead of a cryptocurrency. This makes it the ideal choice for folks that are interested in digital gold investment, but not crypto as a whole.

This is not to say that it isn’t a fully-fledged crypto asset. Its underlying Layer 1 blockchain network Algorand is just as capable as the networks behind the other coins on my list.

Ratio with reserved gold

1 MCAU token is equivalent to one gram of physical gold in the reserve.

Understanding Gold-Backed Cryptocurrencies

Before we explore the factors behind my selections for the top five gold-backed crypto assets, let’s take a closer look at what gold-backed cryptocurrencies even are.

What is a gold-backed cryptocurrency?

To summarize, gold-backed cryptocurrencies are a type of commodity-backed stablecoin. Think of it this way.

The value of traditional cryptocurrencies — like ETH and BTC — comes from factors like their limited supply, mining difficulty, and the trust that these coins are legit forms of currency. They are not backed by anything physical.

Gold-backed cryptocurrencies, on the other hand, are backed by physical gold. Take PAXG for example. Each PAXG token is backed by one fine troy ounce of gold. So whenever Paxos issues a new PAXG token, they also set aside a physical ounce of gold as a security.

Advantage of gold-backed cryptocurrencies

The biggest advantage of gold-backed cryptocurrencies is their relative stability and growth potential.

It’s no secret that gold is a fantastic investment. Even during the 2020 pandemic, the value of gold increased by as much as 40%. In my experience, even a global recession isn’t enough to plummet the value of gold — making it one of the safest ways to store your hard-earned money.

The only downside of investing in gold is having to manage and store physical gold. Gold-backed crypto assets remove all of this hassle.

The gold you bought with through these cryptocurrencies is stored safely in secure vaults. All the while, you have a digital ownership certificate in the form of a crypto token that you can easily transfer and transact with.

Most top-tier gold-backed cryptocurrencies also allow you to redeem your digital token for physical gold if you want.

Criteria for the Best Gold-Backed Cryptocurrency

Now that you understand the value of gold-backed cryptocurrencies, it’s time to understand what makes some of them better than others. Here are the factors I considered when choosing the top options for my list:

Transparency and auditability of gold reserves

The gold reserves are the backbone that gives value to any gold-backed cryptocurrency. So, the issue should provide regular audits for their reserves to ensure that each token they issue is legit.

Security and storage of physical gold

If the gold in the reserve gets stolen, there is a high likelihood that every holder of that crypto asset will lose all of their investment. To avoid any such outcome in the future, pick an asset that promises proper security for its reserves.

Accessibility and liquidity of the cryptocurrency

You do not want to get stuck with gold that you cannot sell or transfer for something else. At the end of the day, gold that you cannot exchange for fiat or other goods is a fairly useless investment.

I’d suggest you look for coins that have high liquidity like PAXG or the ones that offer to redeem for fiat at any time like PMGT.

Reputation and trustworthiness of the issuing entity

This might sound a bit obvious but it needs to be said in clear terms. Make sure the crypto issuer you’re entrusting with your gold investment has a good reputation in the community.

Risks and Considerations with Gold-Backed Cryptocurrencies

There is a lot I can praise about gold-backed cryptocurrencies. However, it would be very wrong of me to say that these coins are the perfect investment because they’re not.

From what I know, these are some of the biggest potential risks of gold-backed cryptocurrencies.

Volatility and price fluctuations

Gold is a lot more stable than say Bitcoin, but is still quite rocky on a larger scale. It can experience volatility and price fluctuations just like any other investment. Make sure you’re prepared for this volatility before investing in gold-backed cryptocurrencies.

Regulatory and legal considerations

Unlike BTC or ETH which are entirely digital on the blockchain, gold-backed coins have a physical element to them that needs to be stored somewhere.

What if the country where the reserves are located bans crypto? This is — of course — a hypothetical, but situations like this can occur and cause massive issues for you.

Counterparty risks and audits

This isn’t as big of a concern with well-known issuers like Paxos or Tether. However, a new startup offering gold-backed crypto could be a complete scam with fake audits and it would be very difficult to know for sure.

Conclusion

There is no denying the fact that gold-backed stablecoins can provide a safer and more stable investment opportunity than traditional crypto assets. But, I’d also like to clarify that the success of your investment depends heavily on the exact token you choose.

If you’re unsure, just pick any one of the five top options I’ve listed above and you’re set.

That said, I still recommend doing your own thorough research before spending even a dollar on gold-backed cryptocurrencies. This way, you’ll be able to spend your money on a coin that fully meets your expectations and requirements.