Key Takeaways

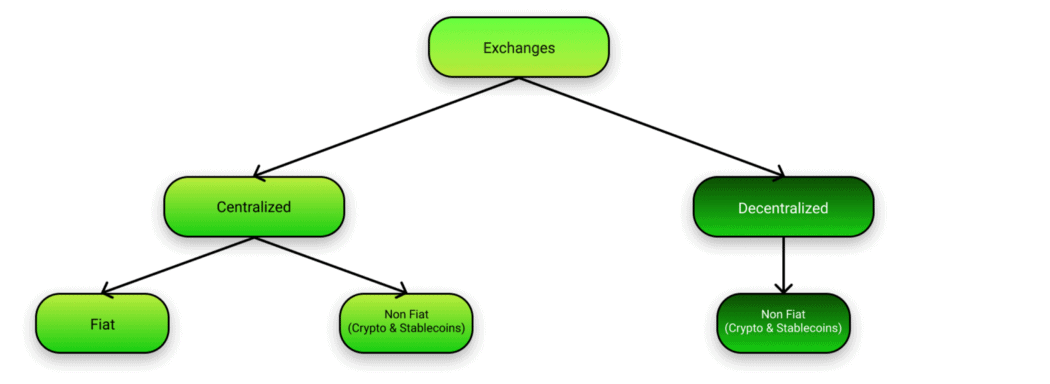

- Cryptocurrency exchanges can be divided into two categories: centralised and decentralised.

- When setting up a wallet, it is essential to check which wallets are most commonly used by the cryptocurrency you are intending to buy.

- The most popular centralised fiat-to-crypto exchanges include Coinbase, Kraken, Gemini, Binance, Poloniex, Bittrex, and Crypto.com.

- In addition to exchanges, other methods of acquiring cryptocurrencies include cryptocurrency or Bitcoin ATMs.

One of the best ways to better understand the emerging cryptocurrency & Bitcoin ecosystems is to actually buy some and finally try it out for yourself. Before you begin there are a few things you should know about the different kinds of cryptocurrency exchanges!

As things stand in 2021, the only way one can obtain cryptocurrencies to mine it yourself, buy it with another cryptocurrency or simply buy it with fiat currency (USD, EUR, CNY, JPY). For this article, we will focus on the latter as it is the easiest and most accessible means of accessing the market for the average person. The main ways of purchasing cryptocurrencies include but are not limited to:

- Exchanges (Centralised & Decentralised)

- Bitcoin/Cryptocurrency ATMs

- CFDs (Contracts for Difference)

- Peer-to-Peer/Local Dealers

For most of this article, we will focus on what exchanges are and what you should know.

Exchanges

Cryptocurrency exchanges can be broadly separated into two categories, ones that deal with fiat currencies and ones that don’t. Due to KYC/AML obligations imposed by governments and banks, buying your first coins with fiat currencies is the most burdensome part of the whole process. Due to the risk of financial and other crimes, currency flowing to these exchanges must be recorded in most countries in the world to be able to identify the source of funds if crime is committed. Once inside the cryptocosm however, you are able to take your coins wherever you please.

Wallets

The first thing you will want to do once you have figured out whatever coin you are interested in buying is to get yourself a wallet for that coin if you want to store your coins securely. Thousands of wallet options exist for Desktop (Windows/Mac) or Mobile (iOS/Android) and often different coins have their own specific wallets.

Getting set up with a wallet is absolutely essential as exchanges, particularly with less tightly regulated exchanges that only deal in crypto to crypto trades. The best way of working around the volatility of these companies is to stick with the big names, particularly ones which are known to have regulatory oversight and hold all of your crypto funds yourself in your own wallet which only you can access. You are of course free to keep and store your funds with the exchange of your choice but there is a long and mired history of exchange thefts, hacks and other swindles. It is for this reason that is almost unanimously recommended that you store your coins on your own hardware and you record all the details involved with setting up your wallet.

Popular wallets include Exodus, Blockchain.info, Bitcoin.com, Breadwallet, Freewallet among many others. You will have to check which wallets are most commonly used by the cryptocurrency you are intending to buy.

Types of Exchanges

Exchanges in cryptocurrency can be divided into two main designs: centralised and decentralised (often abbreviated as DEXs.)

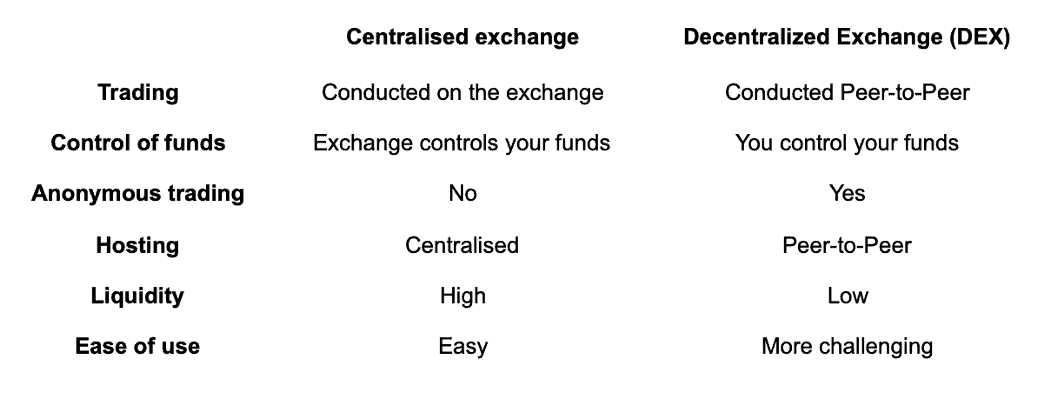

Both have their own benefits and drawbacks. Centralised exchanges have comprised the overwhelming majority of trading volume in the cryptocurrency markets, boasting the most liquidity. With centralised exchanges, users do not control their own funds when the balance is with the exchange meaning that if there are hackers or server downtime, users are unable to access their cryptocurrency, often temporarily and sometimes permanently. While there is a higher risk of potential fund lost in a catastrophic scenario, these exchanges are mainly comprised of well-known fiduciaries who have proper legal structures and regulatory compliance. In addition to this, they can also offer more advanced trading features and are less technically confronting to new users.

DEXs on the other hand are completely peer-to-peer or hybrid peer-to-peer where users connect directly to other users to fill bids and asks on the open market. As these exchanges have no central wallet to deposit and trade with, funds are controlled by the user themselves and there is no risk of losing funds if the network is disrupted. As these exchanges have no proper legal or controlling entity, they have no means of accepting direct fiat deposits, though they are often able to use tokenised fiat solutions such as USDT. For most users, this is a significant drawback and is compounded by lower liquidity/market depth and they have a higher learning curve for new users.

Popular Centralised Fiat-to-Crypto exchanges

Many exchanges around the world can be very local to a particular jurisdiction and focus on deposit and withdrawal methods that are unique to that country. Some exchanges however operate internationally. The most popular exchanges here include:

Depending on your country, deposit methods vary and often include or exclude deposit options including debit and credit cards (VISA, Mastercard, AMEX), PayPal, bank transfers and so forth. These websites have a straight forward sign up process typically involving some form of KYC, following which you can then deposit and buy your first cryptocurrency.

Popular Decentralised Crypto Exchanges

A number of popular DEXs exist today, though these are still maturing and the space moves quickly. They can often be tied to particular cryptocurrency ecosystems such as Ethereum or can include may cryptocurrencies, and consequently they have varied sign up processes.

- Binance DEX

- dYdX

- Kyber Network

- SushiSwap

- UniSwap

- PancakeSwap

Other Methods

Though the main methods of acquiring cryptocurrencies tend to revolve around exchanges, there do exist a number of less travelled paths where you can acquire your first cryptocurrencies. Among these as one of the most common methods are cryptocurrency or Bitcoin ATMs which accept cash payments at a digital kiosk in exchange for the equivalent amount in a cryptocurrency to be sent to a cryptocurrency wallet of your choosing. This is relatively quick and painless, albeit these are less competitive on fees and increasingly around the world demand some form of KYC, usually in the form of a photograph of your driver's license or ID card in the machine. These machines sometimes operate unidirectionally (buying fiat for cryptocurrency) and sometimes bidirectionally (also selling fiat for cryptocurrency.) As of 2021, it is estimated that approximately only 22.2% of crypto ATMs do both buying and selling, and these machines are subject to evolving local legislation which regulates what they’re allowed to do and how. If you would like to see what is available near you you can search your area using Coin ATM Radar.

Another method is Cryptocurrency CFDs or “Contract for Difference” which allows you to speculate on the price movements of cryptocurrencies including Bitcoin, Ethereum or another as well as bundles or indices of crypto. The main benefit of this solution is that the client does not need any sort of crypto exchange account or particular crypto wallet, though the coins themselves are held custodially by the contract issuer. Individuals who are more experienced with buying shares and ETFs may find this solution more suitable for their purposes.

Finally, a number of peer-to-peer solutions have emerged which allow users to organise with an independent seller in person or online with various local payment methods including bank transfers or cash payments. These methods can sometimes be less stringent and are often done at a premium, particularly if payment methods are easily reversible such as those done with PayPal. Websites that connect users for these services include but are not limited to LocalBitcoins, LocalCoinSwap and Local Bitcoin.

Caution

The cryptocurrencies are extremely volatile and are well known for huge swings up and down in value. This article is not financial or investment advice. Individuals should not speculate more than they can afford to lose.