Key Takeaways

- Maker fees are charged to traders who place limit orders that are not immediately fulfilled, increasing the exchange's liquidity.

- Taker fees are charged to traders whose orders are completed immediately, removing liquidity from the market.

- Maker fees are usually lower than taker fees and can sometimes result in rebates for the trader.

- The fees set by crypto exchanges and the trader's trading volume are key factors that determine the maker and taker fees. Different exchanges have varying fee structures.

If you look up trading fees for crypto exchanges, on many of them you’ll find two numbers: a “Maker” fee and a “Taker” fee. Why is that?

To summarize, maker fees are charged to those who place limit orders that are not fulfilled immediately. These orders are added to the order book, thus increasing the exchange’s overall liquidity.

Taker fees, on the other hand, are for orders that are completed as soon as they’re placed. Due to their immediate completion, taker orders remove liquidity from the market.

Having an understanding of how maker and taker fees work is crucial for becoming a successful trader. This is because the difference between these fees can have an effect on the profitability of your trading sessions.

With that in mind, let’s take a closer look at what these fees are and how they affect your trading success.

Definition of Maker and Taker Fees

Maker Fees

As we mentioned earlier, maker fees apply to orders that are not executed as soon as they’re placed. For this to happen, a trader will have to place a sell order with a price that is higher than the highest buy order.

For example, let’s say the highest amount buyers are willing to pay for ETH is 1,100 USD. If a seller places a sell order for their ETH assets at 1,200 USD per coin, that order will not be completed immediately and will get added to the order book.

Now, the ETH coins added by this 1,200 USD pending sell order add to the exchange’s liquidity and market depth. It shows that there is more interest in trading ETH on this particular platform, which is why many exchanges incentivize maker orders with lower fees and sometimes even rebates.

Taker Fees

Taker fees, on the other hand, are charged on orders that are completed immediately. This happens when a trader places a “market order” that is matched with a pending order in the order book and executed on the spot.

For example, let’s say the order book has a pending sell order for 1 ETH at 1,200 USD. Now if a trader places a buy order at 1,200 USD, they’ll get that 1 ETH straight away. This will also remove that 1 ETH from circulation in the exchange — reducing its liquidity and market depth.

Taker fees are usually higher than maker fees because exchanges want as much liquidity as they can. You can also think of them as extra charges for the convenience of fast trade executions.

Difference Between Maker and Taker Fees

As we discussed above, maker fees are usually lower than taker fees. Depending on their trade volume, makers can receive discounts, zero fees, or even negative fees, i.e. rebates on their orders.

Let’s say an exchange is charging a 0.09% taker fee on BTC orders and a -0.05% maker fee on the same assets. If the price of 1 BTC is 30,000 USD, here’s how you can calculate the fee:

Taker fee = 30,000 X 0.09% = 27 USD

Maker fee = 30,000 X -0.05% = -15 USD

In this situation, the taker will have to pay 27 USD, while the maker will receive a 15 USD rebate.

Factors That Affect Maker and Taker Fees

In our experience, there are two key factors that determine how much maker and taker fees you have to pay when trading crypto.

Fees set by the crypto exchange

In the vast majority of cases, both maker and taker fees are set by the exchanges. While they don’t publish their reasoning behind choosing a specific number, we can assume that it depends on their internal financial planning and business model.

For instance, a newer exchange might start with low trading fees to attract new customers. On the other hand, an established platform can have higher fees to increase company earnings.

This is also why we see so much variety in maker and taker fees across different exchanges.

Another interesting point is that there is no standardized ratio for the difference between maker and taker fees. For example, Kraken charges 0.26% for takers and 0.16% for makers (0.1% difference), while Binance charges 0.1% for makers and takers (no difference).

Increased trading volume means lower fees

This is where things can get a bit more complicated. The thing is, often the base trading fees set by exchanges are not fixed.

This is not to say that you can bargain them down and offer to pay less fees on your own. Instead, the exchange will automatically give you a discount if you have a high enough trading volume within a certain amount of time.

Take Kraken for example. It has a base maker fee of 0.16% for standard trading pairs and 0.20% for stablecoin and FX pairs. But, this fee can go as low as 0.00% (zero) if you have a high enough trading volume in the past 30 days.

Keep in mind that these fees are not equal for all types of trading either. Going back to the Kraken example — the taker fee only goes down from 0.26% to 0.24% if you trade more than 50,000 USD in the last 30 days.

Comparison of Maker and Taker Fees Across Different Exchanges

Now that we have a better understanding of how maker and taker fees work, let’s see how different exchanges compare to each other in this regard:

Bybit

Bybit has a variable fee structure that depends on your “VIP” or “Pro” level. For instance, you will have to pay 0.1% for both the maker and taker fees if you are not a VIP. Then, at the “VIP 1” level, these fees go down to 0.06% for takers and 0.04% for makers.

The lowest spot trading fees on Bybit are for the “Supreme VIP” and “Pro 3” account levels. With either of these levels, you’ll only pay 0.02% on taker orders and just 0.005% on maker orders.

Binance

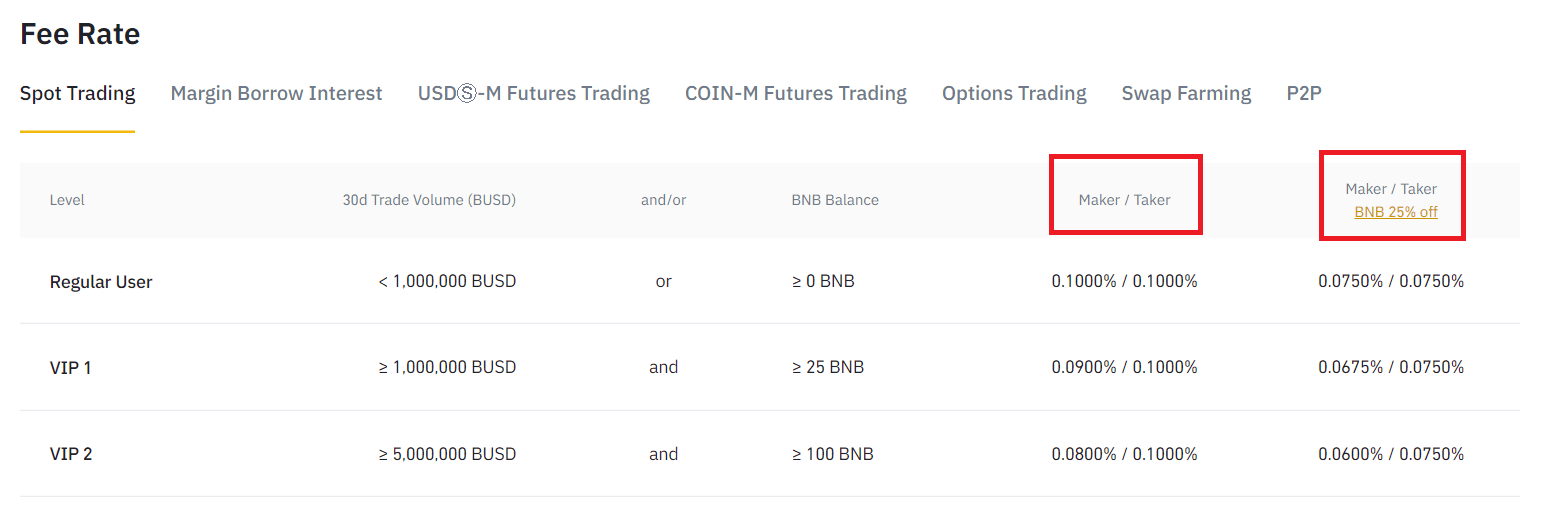

Binance uses a similar VIP level-based variable fee system as Bybit. Under this system, a regular user without a VIP level would have to pay 0.1% on both maker and taker trades.

The highest account level (VIP 9), on the other hand, lowers these fees to 0.02% for makers and 0.04% for takers in spot trading.

MEXC

The maker fees on MEXC are 0.00% for spot trading, and 0.1% for takers. Zero trading fees are a major pro of using MEXC for your crypto trading.

KuCoin

If your account is at level 0, KuCoin spot trading fees are 0.1% for both makers and takers. You do get a 20% discount down to 0.8% fees if you pay with KCS; KuCoin’s native token.

On the far end, on a level 12 account, your taker fee will be down to just 0.025%. Makers get an even larger discount at this stage with a -0.005%, meaning they get a 0.005% rebate on every order.

Bitget

Unlike three of the exchanges we’ve discussed so far, Bitget has a very straightforward fee structure. For normal trades, both maker and taker fees are 0.1% of the traded amount. The only discount you get on these is a 20% reduction for using BGB (Bitget token) for payment.

Factors to Consider When Choosing an Exchange Based on Fees

There are two key factors that you must consider before choosing an exchange based on its fees.

Additional fees

In this article, we’ve focused completely on the taker and maker trading fees, but they are not the be-all and end-all of exchange charges. Many exchanges also charge fees on deposits and withdrawals that can also vary depending on which currency you’re depositing/withdrawing.

Other attributes

We are not against choosing an exchange based on its fee structure. However, there are a lot of other attributes that you have to evaluate before investing your hard-earned money. These include:

Conclusion

Let’s go over it from the top, one more time. In crypto trading, orders that are executed immediately are charged a taker fee, while pending buy or sell orders are charged a maker fee. These fees can vary drastically depending on the exchange and your account level. In most cases, maker fees are either equal to or lower than taker fees, but not higher.

Understanding how these fee systems work can help you optimize your trading strategies for maximum profits and convenience.

For example, if you’re trading without a VIP account on Binance, both sides are charged an equal 0.1% fee. In this situation, you’re better off doing taker orders to get faster order execution. But, if you’re at VIP level 9, doing maker orders will cut your trading fees in half.

So, make sure to do your research and analyze the complete fee chart of the exchange you’re using before forming a trading strategy.