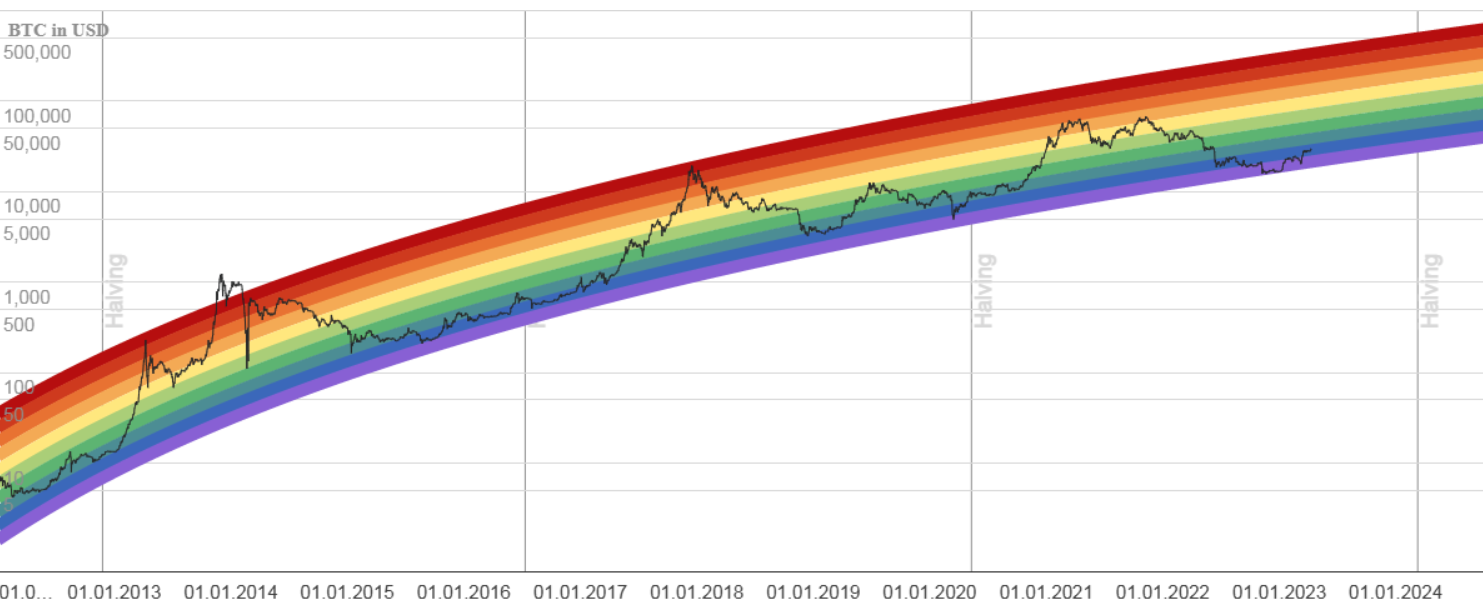

Bitcoin, the world's first and most popular cryptocurrency, has seen immense growth and volatility since its inception in 2009. As the value of Bitcoin constantly fluctuates, the need for a tool to help investors track its historical performance became necessary. This is where the Bitcoin Rainbow Chart comes in.

To summarize, the Bitcoin Rainbow Chart is a visual representation of Bitcoin's historical price movements. This movement is plotted on a logarithmic scale and color-coded to represent the asset's market cycles.

Let’s explore the Bitcoin Rainbow Chart in further detail to understand its purpose, learn how to interpret it, and recognize its limits.

Understanding Bitcoin Rainbow Chart

The Bitcoin Rainbow Chart works by using a logarithmic scale to plot Bitcoin's price movements on the y-axis and time on the x-axis. The chart also divides Bitcoin's price range into different colors, with each color representing a different price range. Listed below are the colors and what they mean.

Benefits of the Rainbow Chart

Here are some key benefits of the Bitcoin Rainbow Chart we’ve noticed during our time using this tool:

Visual representation

The Rainbow Chart makes it noticeably easier to identify market trends and make informed decisions about buying or selling Bitcoin.

Support and resistance levels

The chart shows areas of support and resistance, which can be used to identify key levels for buying or selling Bitcoin.

Risk management

The colors on the chart are direct indicators of the risk involved in buying or selling Bitcoin — knowledge you can use to maximize profits.

Components of the Bitcoin Rainbow Chart

The four primary components of the Bitcoin Rainbow Charts are:

You don’t have to master these all at once. But learning them will give you a better understanding of the Rainbow Chart than “red means sell” and “yellow means hold.”

Moving Averages

Moving averages represent the mean fluctuation of a set of data over a period of time.

In Bitcoin Rainbow Charts, these averages are used to smooth out the price data — allowing you to identify trends and potential reversal points. These averages are also mainly used for long-term trend identification. When the price is above the moving average, it is considered bullish, while a price below the moving average is bearish.

Relative Strength Index (RSI)

Relative Strength Index is one of the most important indicators for us. It measures the momentum of the price movement, indicating whether Bitcoin is overbought or oversold.

The RSI oscillates between 0 and 100. If this value is above 70, Bitcoin is overbought. On the other hand, a value below 30 indicates oversold conditions. Integrating RSI into your Bitcoin trading routine can help you stay ahead of the market — leading to successful price predictions.

Fibonacci retracement levels

On the technical side of things, Fibonacci retracement levels are created by first plotting a trend line between two extreme points on the Bitcoin Rainbow Chart. This trend line is then divided into five sections with horizontal lines based on the Fibonacci ratios i.e. 0.0%, 23.6%, 38.2%, 50%, 61.8%, and 100%.

These retracement levels can show you identify potential buying or selling positions. You can also use them to set up stop-loss points or set price targets.

Trendlines

Trendlines are the simplest component of Bitcoins Rainbow Charts, as they’re often straight lines that are drawn between two or more price points. If nothing else, we suggest learning what these trendlines mean in the Rainbow Chart first, so you can evaluate the overall movement of the market.

Interpreting the Bitcoin Rainbow Chart

In our experience, your interpretation of the Bitcoin Rainbow Chart has a direct correlation with how useful it is for you. With that in mind, let’s dive deeper into the components of the Bitcoin Rainbow Chart to help you understand their potential uses:

Analyzing the Moving Averages

The most important use of moving averages is to help you identify trends in Bitcoin prices. This will also make it easier to spot potential buying or selling opportunities.

For example, let’s say the price of Bitcoin is consistently above its moving average. This is likely a bullish signal — indicating that the asset is likely to continue rising in price and you should consider purchasing.

Analyzing the RSI

We’ve already mentioned how a Relative Strength Index value above 70 means Bitcoin is overbought and values below 30 show that it’s oversold.

From what we’ve seen of the Bitcoin market, an overbought condition is a sign of an upcoming price decline. In other words, a correction or pullback is happening soon.

Conversely, when the Bitcoin price is in oversold territory, this suggests that it may be a good time to buy. But, the RSI should not be the only indicator you use to make a purchasing decision.

Analyzing the Fibonacci retracement levels

The three Fibonacci ratios to look out for in Bitcoin Rainbow Charts are 38.2%, 50%, and 61.8%. If the Bitcoin price approaches one of these levels and bounces off of it, this suggests that buying pressure is strong enough to support the price.

On the other hand, say the price breaks below a retracement level. In this case, the selling pressure is likely to take over and the trend is likely to reverse.

Analyzing the Trendlines

The Bitcoin Rainbow Chart can include both support trendlines (drawn below the price) and resistance trendlines (drawn above the price).

If the Bitcoin price approaches a support trendline, it will likely encounter buying pressure and can go back up. Alternatively, if the Bitcoin price approaches a resistance trendline, it is more likely to reverse its uptrend and start going down.

Conclusion

The different components of this Rainbow Chart give you insight into different aspects of Bitcoin’s price. You cannot rely on just one of them to make consistently successful purchasing or selling decisions. So, make sure to learn what each of them means and include all of them in your arsenal of trading tools.

Advantages of the Bitcoin Rainbow Chart

If you’re still unsure about the usefulness of the Bitcoin Rainbow Chart, here's why we personally use it on a regular basis:

Easy to interpret

Once you understand its basics, you can interpret a lot of useful information from the Bitcoin Rainbow Chart rather quickly.

Helps in decision making

We used this tool to make well-informed and fairly successful Bitcoin investment decisions. It has also helped us make price predictions that would’ve been very challenging without it.

Can be used for long-term investments

The condensed, logarithmic design of the Bitcoin Rainbow Chart makes it a powerful resource for making more reasonable long-term investments.

Risks of relying solely on the Bitcoin Rainbow Chart

We can spend more time praising the utility of the Bitcoin Rainbow Chart. But, we don’t recommend relying solely on this one tool. Here’s why:

Market Volatility

Bitcoin — and crypto by extension — is a famously volatile market and the Rainbow Chart cannot help you predict unexpected changes.

Technical Indicators may be insufficient for analysis

Technical indicators like the Rainbow Chart can be helpful, but they are not always sufficient for comprehensive analysis. Other factors like market sentiment, news events, and regulatory changes can all impact Bitcoin's price movements.

Possibility of misinterpretation

If you rely solely on the Rainbow Chart, any mistakes in your interpretation and understanding can be disastrous for your Bitcoin portfolio.

Conclusion

The Bitcoin Rainbow Chart is one of the most reliable indicators for analyzing and understanding the history of Bitcoin price movements. Its colorful representation of the data also makes it super easy to interpret, even for relatively new investors.

However — just like any other indicator — it is nothing but a simple tool to help you make successful buying or selling decisions. Use it as often as you can, but don’t make it your only source of information on Bitcoin price trends. Remember to always do your own research, keep up with the latest news, and consider a variety of indicators before making any investment decisions.

You may also want to read about the Ethereum rainbow chart, which is the equivalent for ETH.