For new crypto traders, Robinhood is a highly appealing option, as it is user-friendly, allows users to buy and sell crypto, and is simple to use and secure.

Unfortunately, Robinhood does not allow you to earn interest on your crypto, a significant feature that investors want to utilize. If you want to earn interest on crypto, or stablecoins like USDC, check out the excellent options listed below.

| Where to earn interest | Features | Score | Sign Up |

|---|---|---|---|

Earn interest on 350+ coins  | ☑️ Earn interest on a huge range of more than 350+ cryptocurrencies ☑️ High rewards when you lock crypto for 120 days ☑️ Largest crypto exchange in the world | 9.8 | Sign Up |

Best flexible staking rates  | ☑️ Highest rates for flexible staking ☑️ Dual asset mining and liquidity mining available to earn higher rewards ☑️ No KYC required to use this exchange | 9.5 | Sign Up |

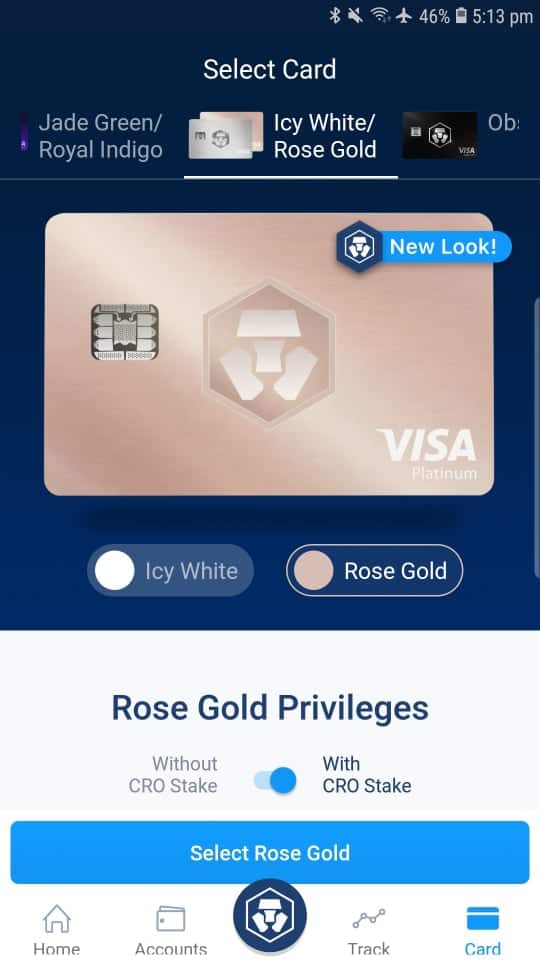

Best mobile app for staking  | ☑️ Easy-to-use mobile app where you can earn interest on crypto in a few clicks ☑️ Earn interest on 20+ coins, with 3-month fixed term giving the highest rewards ☑️ Use the Crypto.com debit card to receive cashback in CRO coins on every purchase | 9.2 | Sign Up |

Best places to earn interest: Individual Breakdowns

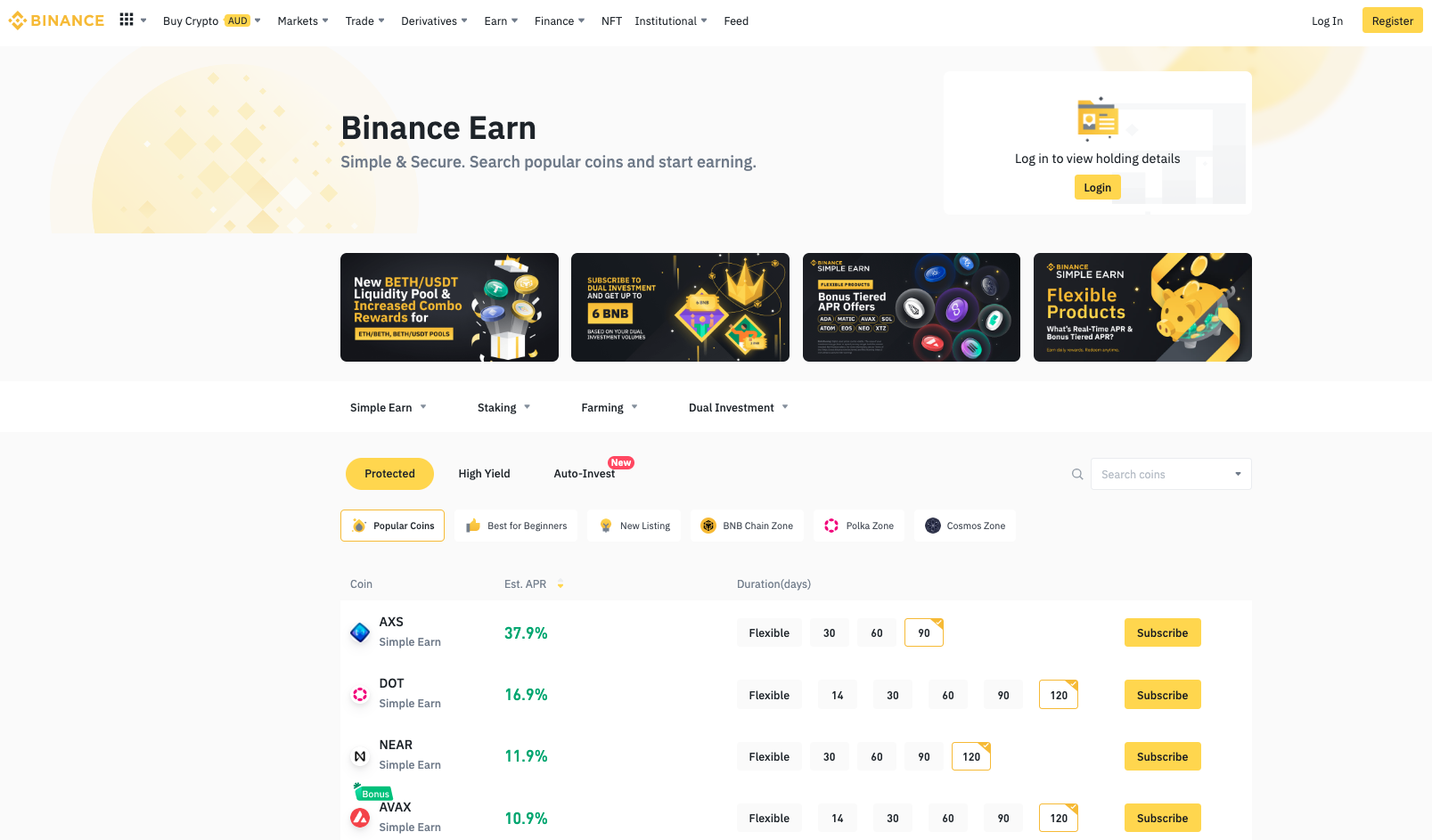

#1. Binance - earn interest on more than 350+ coins

Binance is the biggest cryptocurrency exchange worldwide if you base that statistic on trading volume, and it offers more than 600+ cryptocurrencies to trade.

From the 600+ on offer, 350+ of them allow you to earn interest on them, including popular coins like AXS, BTC, DOT, and ETH, and stablecoins such as USDT and USDC.

The interest rates offered on Binance are quite high, and some coins allow locked staking for up to 120 days, where you receive even better returns. At the time of writing, here are some of the interest rates available:

BTC: 0.44% + 0.25% bonus for the first 0.01 BTC

ETH: 3.87%

USDC: 4.14%

USDT: 2.05% + 1.5% bonus for the first 500 USDT

AXS: 37.9%

DOT: 16.9%

The downside is that Binance is not available in the US. There is a sister site called Binance.US, but they have limited capabilities, including fewer coins. If you are a resident of the USA, we recommend you use Crypto.com to earn interest on your crypto.

- Over 600+ different coins to buy, sell, or trade

- More than 350+ cryptocurrencies to earn interest on

- Higher interest rates are available if you lock for a fixed duration, up to 120 days

- Biggest cryptocurrency exchange in the world

- Not available in the USA

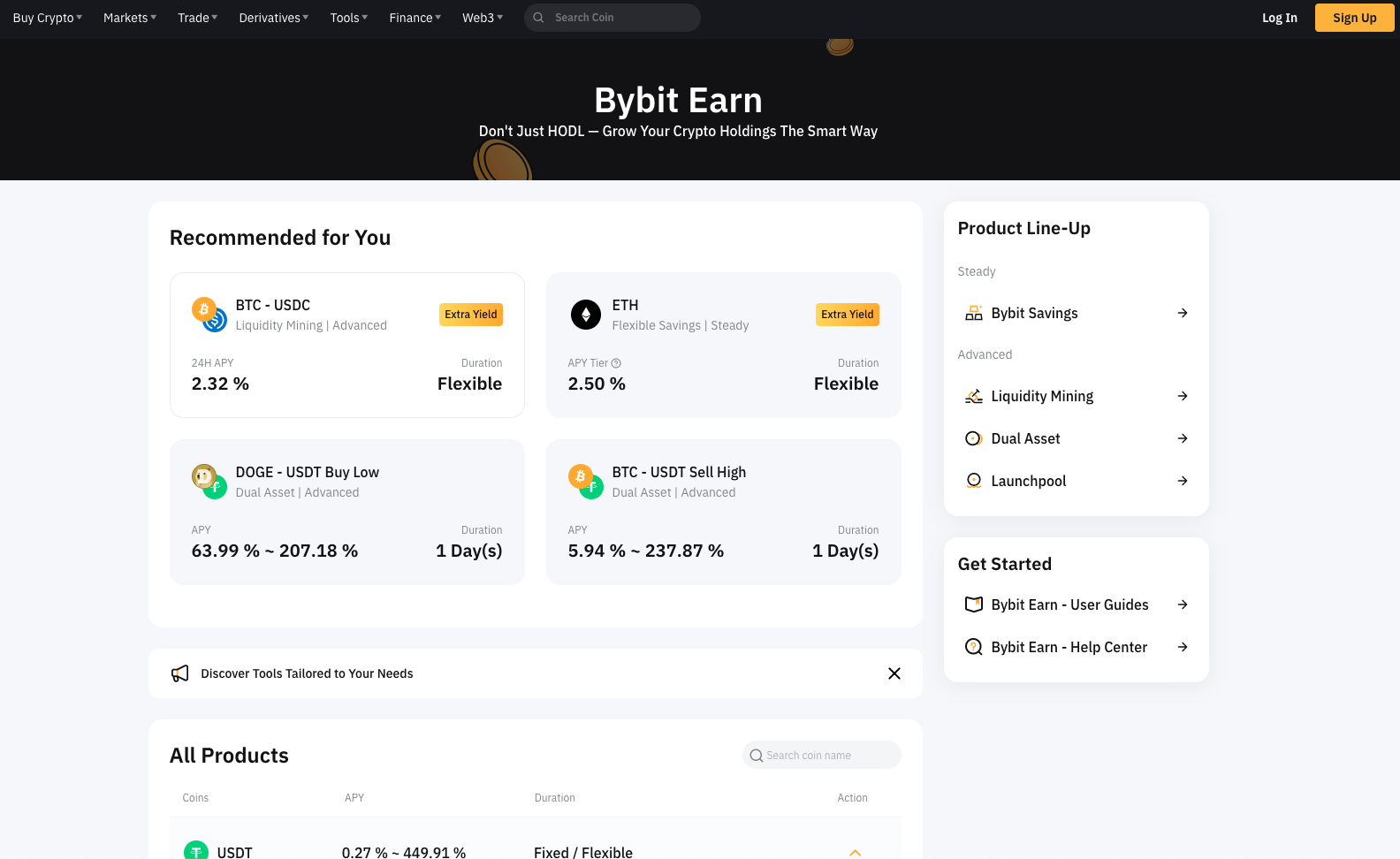

#2. Bybit - high interest rates with flexible staking

Bybit is one of the most popular crypto exchanges in the world, and our #2 recommendation of places to earn crypto interest. It is our top choice if you prefer flexible staking, which means you have the option to stop staking at any time, in order to withdraw, trade, or sell your crypto.

The rewards are higher than Binance's if you look at the rates for flexible staking. Bybit also gives higher rates if you are a small-volume investor. As an example, at the time of writing, you will receive 2.5% APY (on your first 0.2 ETH) when staking ETH on Bybit, but on Binance you only receive 0.53% APY. When you compare a stablecoin such as USDC, on Bybit you receive 8% APY (on your first 500 USDC), compared to Binance's 3.74%.

However, if you stake higher amounts of crypto, the interest rate drops, and you may be better off sticking with Binance. On USDC staking, after your first 500 USDC, the rate drops to 3% APY, and above 5,000 USDC, the rewards are only 1.8% APY.

Bybit is also not supported in the US. However, since you do not require ID to use Bybit, you can use a VPN to get around any restrictions. However, if you don't wish to do this, we suggest you try out Crypto.com, the next app on this list.

- Higher interest rates for flexible staking

- If you are staking a small amount of crypto, you will access higher rewards

- No KYC required, so you can remain anonymous on Bybit

- Very popular cryptocurrency exchange, with over 10 million users in the world

- Not available in the USA

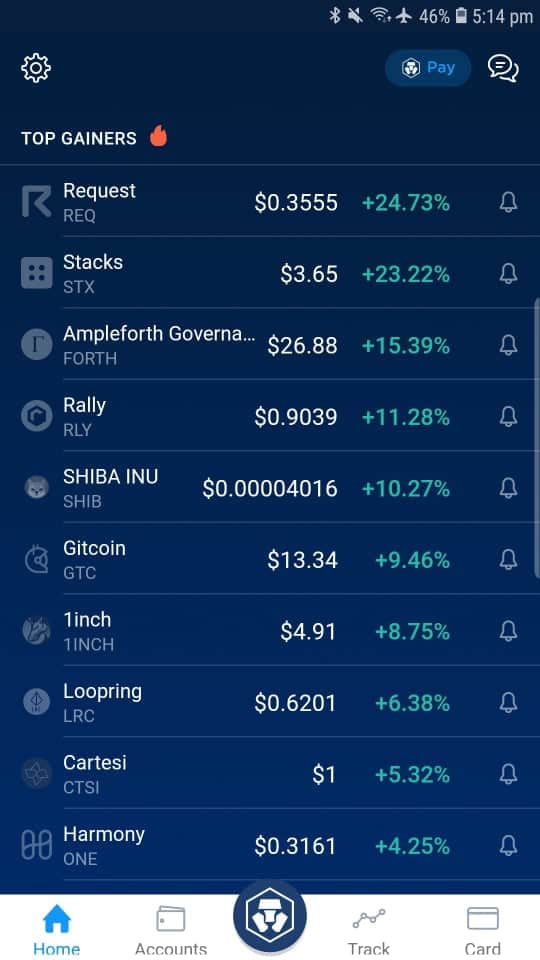

#3. Crypto.com - easiest way to earn crypto

If you are hunting for a crypto interest option that allows you to earn crypto cashback on Visa purchases, look no further than Crypto.com. It is one of the top crypto exchanges worldwide and offers you the chance to earn interest on 47 of the 250+ coins available on the exchange.

One of the main benefits it offers is its mobile app, which lets you purchase, sell, and swap cryptocurrencies easily.

But what really sets Crypto.com apart is the fact it offers users a Visa debit card. There are different levels of Visa Card on which you load your base fiat currency. You then use your card to make purchases in everyday life, and with each purchase, you get a percentage cashback in CRO coins.

As for interest rates, they vary from coin to coin and increase if you opt to fix it for one month, three months, or more. Check out the current rates at the Crypto.com website here.

Crypto.com is an excellent choice if you frequently use your debit card, as the cashback quickly adds up.

- Purchase, sell and swap over 250+ different coins

- Earn interest on 47 cryptocurrencies with the option to lock for 1 or 3 months to access higher rates

- Visa debit card to earn as much as 5% cashback

- You need to lock in for lengthy periods to access competitive interest rates

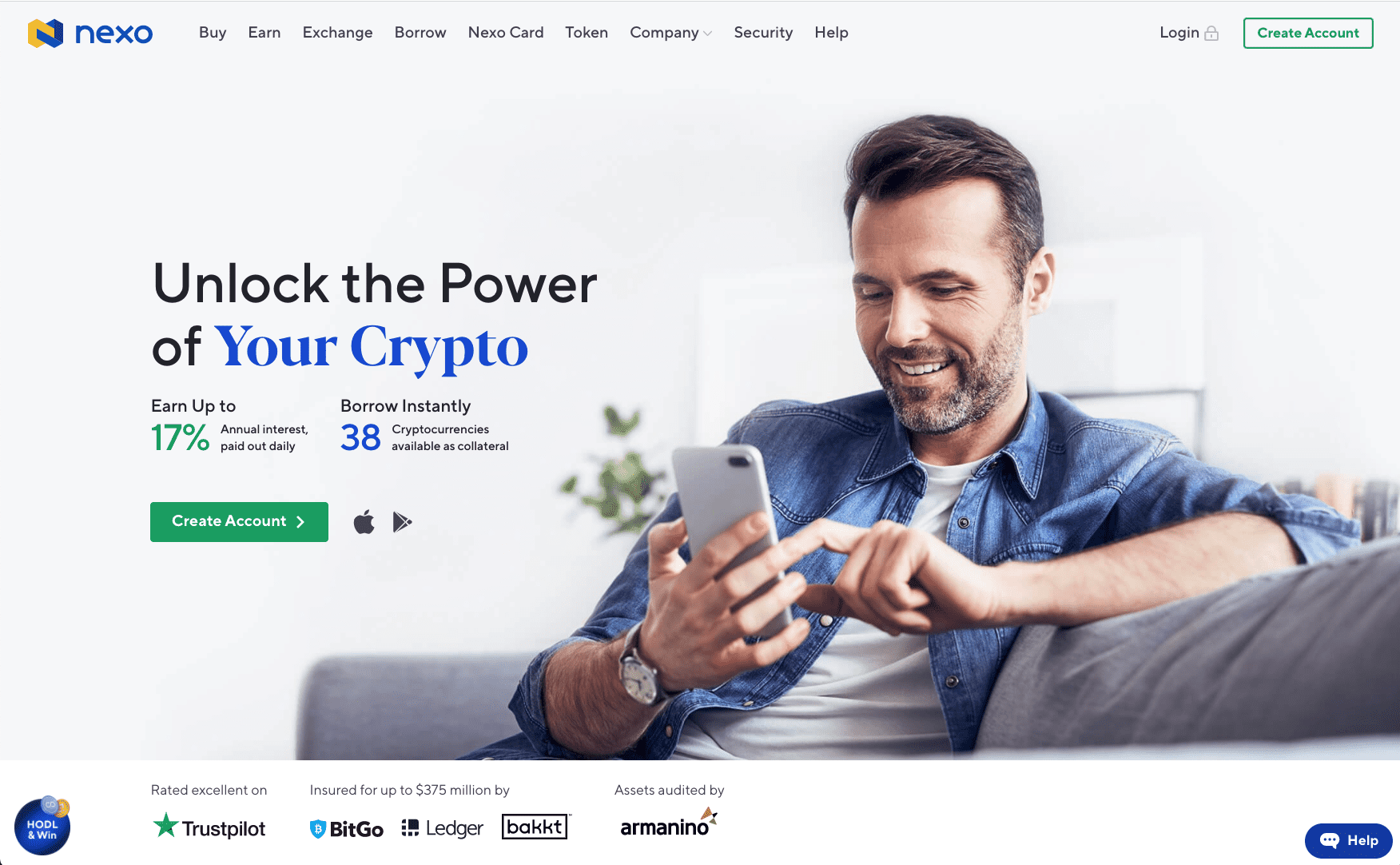

#4. Nexo - earn crypto interest from your wallet

When you are choosing a cryptocurrency digital wallet to safely store your coins, one of the best options available to you is Nexo.

You can use Nexo to purchase crypto straight away, switch between crypto coins, and earn interest on each of the 33 available cryptocurrencies. Nexo even has an excellent signup offer of $25 FREE BTC when you sign up with this link, and deposit $100 for 30 days or more.

Nexo is world-class in regard to security. It uses Class III vaults, military-grade 256-bit encryption, and is ISO 27001 compliant.

As for the interest rates on offer, Nexo offers strong base rates that can be increased through several steps. The base rate for crypto coin interest on Nexo is 8% for stablecoins and for other cryptocurrencies it ranges from 3% for BTC up to 20% for AXS. If you instill a one-month lock on any of your coins, you will immediately receive a 1% APY bonus.

You could also choose to receive your interest paid out in Nexo’s own coin (called NEXO), and receive an additional 2% in interest. Note that you will be paid in NEXO and not the base cryptocurrency you have stored.

Finally, you can earn further interest based on your loyalty to Nexo. The more NEXO tokens you stake in comparison to other coins in your wallet, the more interest you can gain.

- Purchase, store and earn interest on 33 cryptocurrencies

- High base interest rate of 8% on stablecoins and 3%-20% APY on other coins

- Receive 1% bonus interest for 1-month fixed terms, 2% bonus by earning interest in NEXO, and extra interest depending on how much NEXO you have staked

- Free $25 BTC bonus when you sign up and deposit $100 for 30 days

- Easily swap your coins within Nexo

- Earning interest in NEXO is not available in the USA

Where to earn the highest crypto interest?

Binance offers the highest crypto interest rates for fixed duration staking, although on Bybit you can earn higher interest if you plan on keeping your coins flexibly staked.

Is it safe to earn interest on crypto?

When you look at the high interest rates on offer, earning interest on crypto can seem too good to be true. Many people find themselves questioning what the drawbacks might be and whether it is safe.

As with any investment, there is certainly risk involved. When you earn interest on crypto, you are doing so with coins that are not contained in your personal wallet, so they are out of your control.

How much risk is involved will depend completely on which platform you pick and how you deposit your coins. The most significant risks to be wary of are hacks and borrower defaults. Platforms that don’t offer airtight security are much likelier to get hacked. Borrower defaults are impacted by who your platform lends to. If these relationships are clear and strict requirements are set, the risk is reduced.

Ensure you do research before putting any personal information or money into a platform, and be sure to diversify your portfolio by placing crypto on various platforms.

Do I have to pay tax on crypto interest?

Whether earning crypto is taxable or not depends entirely on what your local laws state. However, in most instances, yes, you will be required to report your interest earned as a form of income.

In most cases, you should make a note of the market value of your earnings on the date you received them.

Always be sure to talk to a tax accountant or financial expert for professional financial or tax advice.

Where can I buy cryptocurrency?

If you haven’t already purchased cryptocurrency, ensure you choose the right cryptocurrency exchange for you. Some cryptocurrency exchanges even let users earn interest from their trading platform, so you don’t need to worry about withdrawing and depositing your coins in numerous places.

One good example of this is Crypto.com, as it offers more than 250+ coins for you to choose from, and 47 of those coins offer you the opportunity to earn interest as well. Check out the full Crypto.com review here.

Comparison table: Best Places to Earn Crypto Interest

(Scroll across the table to see all 4)

Marketplacefairness.org provides all its content for informational purposes only, and this should not be taken as financial advice to buy, trade or sell cryptocurrency or use any specific exchange. Please do not use this website as investment advice, financial advice or legal advice, and each individual's needs may vary from that of the author. This post includes affiliate links with our partners who may compensate us.

To read our privacy policy click here.