Key Takeaways

- Over $3 billion is lost annually to crypto hacks, with some estimates reaching $14 billion worldwide.

- Large-scale hacks have seen a 79% increase in 2021, resulting in losses 60 times higher than in 2018.

- Blockchain bridges account for 70% of large-scale hacks, leading to $2 billion in stolen assets.

- Individuals have reported over 46,000 hacking-related losses since 2021, with a median loss of $2,600 per person.

Cryptocurrency is here to stay. The real question is, “In what capacity?” Knowing that a commodity will affect markets in the future is like winning at checkers. Being able to predict how it will affect markets is winning at chess.

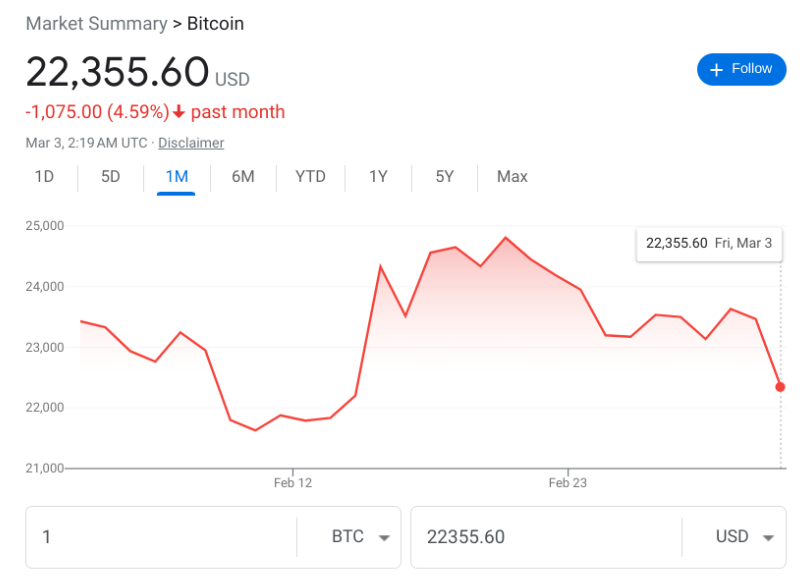

According to an NBC poll, a fifth of all Americans have used crypto [1]. Worldwide, there are over 80 million crypto wallets [2], and the price can fluctuate by thousands of dollars a day, or even by the hour.

With all those millions of people invested in, trading in, and spending with cryptocurrencies, it’s more important than ever that wallets are safe. In this article, we’ll talk about crypto hacking – what it is, how it can affect you, and how to keep you safe. This risks of cryptocurrency hacks are high enough that the Federal Government has issued a warning letter to bankers and insiders in an effort to look out for the rest of us, here’s some facts.

Quick Hits:

What Is Crypto Hacking?

Crypto hacks can take a variety of forms, from the large-scale heists that take hundreds of millions from an entire exchange to the small-time phishing emails that gunk up our spam email folders. But don’t kid yourself. Even something “small-time” can wipe out your entire savings.

The basic concept behind crypto hacking is the manipulation of data. Either by attempting to phish personal information [9], hacking the blockchain directly [10], and any other number of hacks. Below are some stats around the types of crypto hacks. One concept we’ll address is a 51% attack, when a person takes over enough of a blockchain that they can directly manipulate the outcomes.

Large-Scale Hacks

- Total crypto crime rose by 79% in 2021 [11].

- That translates to losses 60 times higher than in 2018 [12].

- Blockchain bridges account for 70% of large-scale hacks, resulting in $2 Billion in stolen assets [13].

- In 2022 alone, users individually lost a combined $1.6 Billion from large-scale attacks [14].

- In one 51% attack, a hacker used short-term Crypto loans to seize a 67% share of of Beanstalk, approved a transfer of Crypto funds to his wallet, and then disappeared; he made off with $182 Million in less than 13 seconds.

- One fast-growing area of opportunity for hackers is Decentralized Finance, or DeFi.

- 21% of all hacks in 2021 exploited weak code in new DeFi companies [15].

- DeFi platforms also accounted for 72% of individual stolen funds.

- Even criminal justice and terrorism agencies have begun to pick up on the Crypto-Crime increases.

- The IRS seized $3.5 Billion in cryptocurrency from criminal operations, representing 93% of all their seized money.

- The Department of Justice took in $56 Million from a scam investigation, $2.3 Million from a Ransomware phishing attack related to pipeline terrorism.

Individual Hacks

It’s bad enough to think that the entire exchange you’re on might lose money. But hackers come after individuals, too.

- Since 2021, over 46,000 people reported losses to hacking.

- The median loss has been $2,600 per person [16].

- One type of phishing, obtaining information by posing as a romantic partner, cost individual consumers $139 [17].

- Social Media is another preferred method of hacking and scamming people’s data:

- The top social media platforms of hacking people are Instagram at 32% and Facebook at 26%.

- 40% of all social media scams for money are in crypto [18].

- According to the Federal Trade Commission, the largest cause of fraud came from bogus investments, at $575 Million.

- Romance Scams came next.

- Business Imposter were responsible for $93 Million,

- and Government Imposters for $40 Million.

- Individuals have had over $3 Billion in crypto stolen directly from DeFi sites.

- People aged 20 to 49 are three times more likely to be scammed than older people.

- 35% of all fraud against people in their 30s is crypto based [19].

What You Can Do

Experts all agree that the best way to secure your tokens or coins is with a cold wallet, like Ledger or Trezor. Other options for online wallets are available, and we have a comprehensive list right here. We’ve reviewed the best on- and offline wallets, and compared all their features.

With crypto crime on the rise, no one can be too safe. With the shift around the globe toward digital currencies, investing in a good wallet could save you from losing thousands of dollars in crypto.

References