Did you know that according to Australia Taxation Office data from June 2022, SMSFs hold around $1.37 billion in crypto assets? Considering the growing trend of investing in Bitcoin through Self-Managed Super Funds or SMSFs, it's evident that this value must have doubled by now.

But why are so many Australians opting to buy Bitcoin with superannuation funds? Is it a simple investment approach? Are there any rules for holding Bitcoin with SMSFs? How can you proceed with this investment? Let's explore all that and much more in this detailed article.

Understanding SMSFs and Bitcoin

What exactly is an SMSF? Simply put, a Self-Managed Super Fund or SMSF is a unique institution that enables Australians to manage and invest their superannuation directly. Unlike traditional industry or retail super funds managed by financial experts, an SMSF gives you the freedom and responsibility of managing your superannuation funds.

This superannuation, usually known as 'super', is Australia's retirement savings system. It contains payments from your company, the money you put in, and any earnings from your superannuation assets. Once you reach retirement age, you can access these super savings, ensuring you live a financially stable after-retirement life.

The autonomy and flexibility provided by SMSFs are appealing to Australian investors, offering greater control over their retirement funds and the opportunity to explore alternative investments — with cryptocurrencies being a popular choice.

Legal and Regulatory Framework for SMSFs Investing in Bitcoin

While you can buy Bitcoin with a superannuation fund, you must comply with SMSF crypto investment rules set by the following government agencies:

As per Australian law, when an SMSF buys in cryptocurrencies or other assets, it must follow both companies' Bitcoin investment rules. Furthermore, the investor needs to work in the best interests of the fund's members while passing the "sole purpose test."

What is this test? Simply put, the fund should be established solely to provide retirement benefits to its members.

Besides that, the Australian Taxation Office (ATO) mandates the following consideration for cryptocurrency SMSF investments in Australia:

Note: All SMSFs must be registered with the ATO and have an Australian Business Number (ABN) and a Tax File Number.

Setting Up Your SMSF for Bitcoin Investment

Now that you know you can buy Bitcoin with superannuation, are you planning to set up an SMSF? While it is a smart investment decision, we suggest you consider the following key aspects of accurately setting up a crypto SMSF Australia.

Consult with a Financial Advisor

Before you get started, it is important to talk to a financial expert about your plans. This is helpful whether you're starting an SMSF for the first time or assessing your current SMSF's ability to invest in cryptocurrency.

Why? Because a financial advisor can provide you with specialised guidance, ensuring that your investment strategy is consistent with your investment objectives, risk tolerance, and regulatory requirements.

Here, it is crucial to have a strong fund investment strategy for your SMSF that specifies the investments the fund can make. For example, a fund must be willing to bear the associated risk because cryptocurrencies are regarded as a riskier investment than government paper money.

You can decide whether your super savings are sufficient to withstand the risks of cryptocurrency losses by consulting with a financial advisor before proceeding with the investment.

Decide the Members and Type of SMSF Trust Structure

If you are setting up an SMSF for the first time, you need to finalise your fund's members and trust structure. Here, you can choose to set up either an individual trustee SMSF or a corporate trustee SMSF.

An individual trustee structure only includes SMSF members who are either trustees or directors of corporate trustees. In contrast, a corporate trustee structure emphasises appointing a trustee company while giving all members equal control to run the fund.

Once you choose which type of trustee structure you want to go with and have all the members that will be a part of the super fund, it's time to set up the SMSF.

For this, we suggest you seek professional assistance to help manage legal and financial concerns linked with setting up an SMSF. This way, you can ensure that your fund is properly set up and meets all legal requirements.

Review and Update the Trust Deed

After speaking with your financial consultant and creating your SMSF, the next crucial step is to check the SMSF Trust Deed. Since the Trust Deed is the cornerstone of your fund that defines its structure and investing guidelines, it's important to ensure no issues with it.

If you're setting up a new SMSF, your deed should be professionally designed and include provisions for Bitcoin investments. However, if you already have an SMSF, you must confirm if your current deed includes such investments. You can always change it if it is outdated or doesn't allow cryptocurrency investments.

Add Bitcoin to Your SMSF Investment Strategy

The next stage is to create a defined investment strategy with the help of your financial advisor. To ensure that you are proceeding with the best SMSF for crypto, this strategy should include cryptocurrencies as a planned asset.

Additionally, it should be consistent with your SMSF's overall investing objectives and risk profile. The best approach to creating a well-defined investment strategy is to document the entire plan, including how crypto assets fit within your overall portfolio.

Register your SMSF

Next, you must register your SMSF with the Australian Taxation Office (ATO). It is worth noting that if a corporate trustee manages your SMSF, then you also have to register it with the Australian Securities and Investments Commission (ASIC).

Open a Bank Account

Lastly, you must open a bank account in the SMSF's name to manage your super funds. This account is integral for separating the SMSF's finances from its members' accounts and establishing clear financial boundaries.

That said, all your SMSF transactions will be handled through this bank account, whether receiving super rollovers, contributions, or investment income. Due to this reason, you must open an account for your SMSF at a trusted bank that provides services exclusively for SMSF organisations. This will ensure that the account setup will meet SMSF rules.

Choosing a Cryptocurrency Exchange and Buying Bitcoin

After establishing your crypto SMSF, it's time you pick a crypto exchange to invest your super funds in Bitcoin. Here, make sure to pick a reliable exchange platform that:

Note: To ensure that your preferred exchange complies with the sole purpose test, you can register your account on an exchange as an SMSF. For this, you must provide essential documents to the exchange, including your personal ID and SMSF deed.

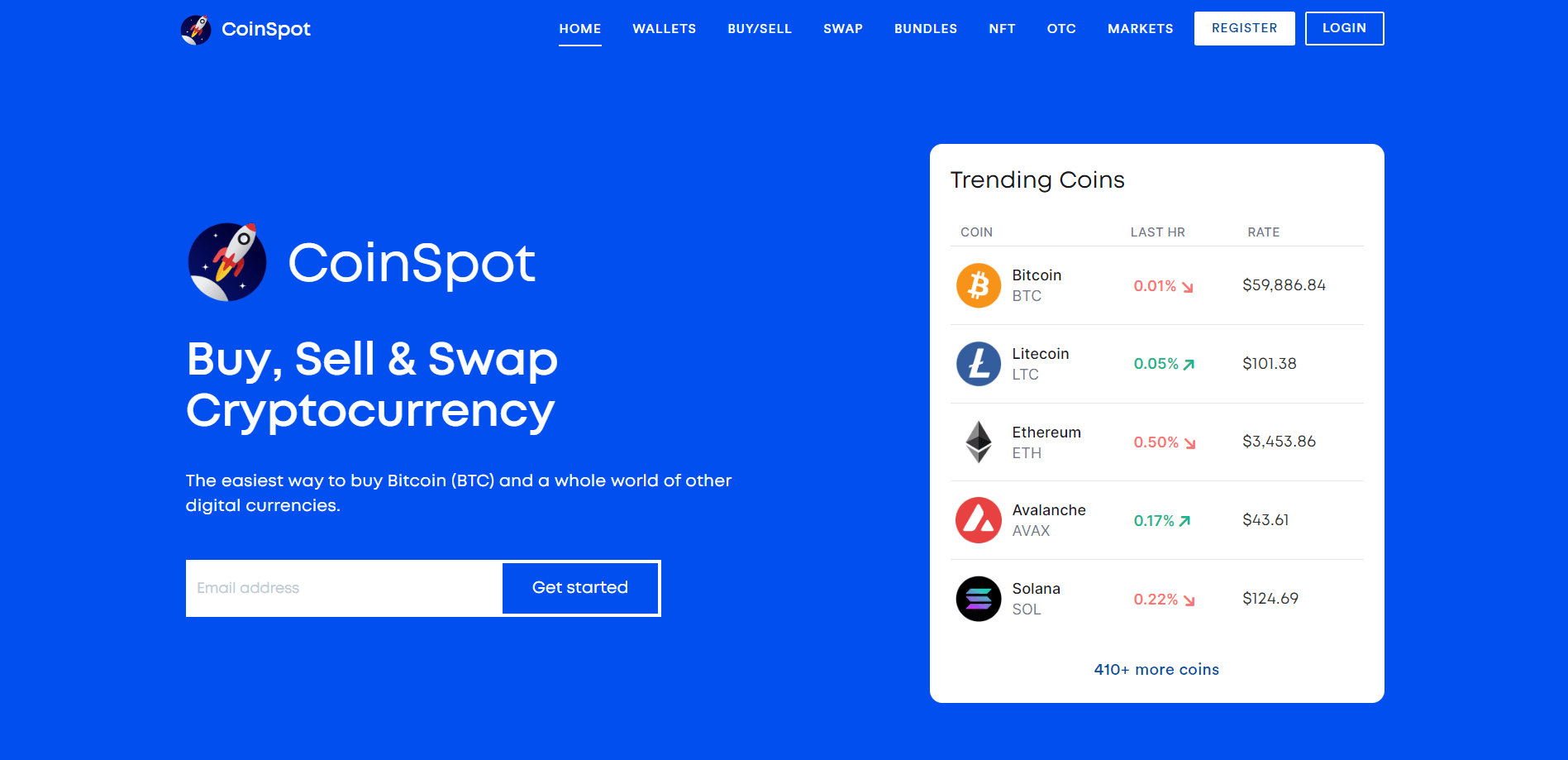

CoinSpot: The #1 Crypto Exchange for SMSFs

Not sure which Australia-based crypto exchange is ideal for your SMSF investment? We suggest you consider CoinSpot, a leading crypto exchange in Australia that distinguishes itself in the market for all the right reasons.

Since its inception in 2013, the exchange has become a preferred trading platform of over 2.5 million Australian crypto investors.

Why? With solid security measures like cold asset storage and HackerOne program in place, a competitive 0.1% trading fee, straightforward user interface, 430+ supported cryptocurrencies, and thousands of positive customer reviews on trusted platforms like TrustPilot – it ticks all the boxes.

With all of that, signing up on the exchange is also quite simple. All you have to do is:

That's it! You can now transfer, swap, or sell your crypto assets through CoinSpot.

Managing Risks and Diversifying Your SMSF Portfolio

Whether you're new or already familiar with SMSF crypto investment, it's important to limit the risks that come with crypto investment. The best way to do that is by consulting a professional SMSF auditor or advisor before processing the investment.

This is a great way to navigate the complexities of SMSF regulations, tax reporting obligations, and compliance requirements while complying with SMSF crypto Australia regulations.

Another way to limit investment risks is to diversify your SMSF portfolio. This way, you can balance your super fund investments with high-performing asset classes that will offset other low-performing assets.

Conclusion

Investing in cryptocurrencies with SMSFs is a smart approach only if you comply with relevant investment regulations in Australia. As mentioned, the best way to do that is by opting for a reliable crypto exchange like CoinSpot and seeking professional advice before making any decisions.

We hope this detailed guide will help you make more informed Bitcoin investments using your SMSFs.