Key Takeaways

- Bitcoin is a technical solution to the problem of reaching a consensus on events without a central authority.

- Digital cash as a means for people to make payments across the internet was a long-coveted idea in computer science, and this is what Bitcoin was meant to facilitate.

- Using Proof-of-Work, Bitcoin is able to overcome the double-spend problem with no central authority.

- Bitcoin's scalability problem means that it is unable to function as an effective medium of exchange.

A lot is currently being made about the significant surge in the price of BTC, the dominant cryptocurrency trading on online markets, though few can explain what the precise value proposition behind Bitcoin is to justify the astronomical rise in price. Nearly every three years, struggled attempts to explain “the blockchain” and Proof-of-Work flood into the social media feeds of potential retail investors in an attempt to explain the value of Bitcoin. After 12 years since the announcement of Bitcoin, however, the system remains largely misunderstood, even by its most staunch advocates.

“Never invest in something you don’t understand” — Warren Buffet

To explain the current state of the cryptocurrency markets it’s essential to first understand where it all began. In 2009, an anonymous developer carrying the moniker “Satoshi Nakamoto” announced a “new electronic cash system that’s fully peer-to-peer, with no trusted third party” on the cryptography mailing list in October of 2008. Its main properties were described as:

- Double spending is prevented with a peer-to-peer network

- No mint or trusted parties

- Participants can be anonymous

- New coins are made from a Hashcash style proof-of-work

- The proof-of-work for new coin generation also powers the network to prevent double-spending

In this article, I am going to explain the ramifications of these properties and how they stand against the current implementation of what is erroneously understood as Bitcoin which trades under the ticker symbol BTC today which underpins most of the market.

The problem

Bitcoin was a technical solution to the problem of reaching a consensus on events without a central authority. The current model of the internet is largely driven by trusted third parties such as Facebook, Twitter or Instagram who collect data and distribute it out to other users on your behalf. In doing this, they implement a permissioning system as the trusted party so only you can write posts to your account and so everyone else can see that these posts are from you, and belong to you. Similarly, our modern banking and monetary infrastructure depend on the same trust-based model — your bank authorises you to spend what you have on-demand, and you trust them to accurately record debits and credits. This has naturally lead the power of money to lie in the hands of commercial and central banks who have wide discretion over policy.

Digital cash as a means for people to make payments across the internet without the legacy financial system has been a long-coveted idea in computer science, so much so that the HTTP specification preempted the inevitable introduction to such a solution with the 402 Payment Required client error stub (one of the many others including 404 Not Found and 500 Internal Server Error). This would have enabled the internet to theoretically scale to hundreds of millions of concurrent users without out significant losses of privacy from ad-based data mining for instead a fast, efficient and frictionless micropayment system. This is what Bitcoin was meant to facilitate.

The central impediment which prevented the creation of such a system was known as the double-spend problem. Put simply, you can’t have a monetary system where records of cash transfers can be as easily duplicated as copying an image, as this would instantly jeopardise the issuance of currency.

Digital currency is one of the trickier challenges for any game designer, if only because copying digital files is so easy. To a large extent, the problem is not much different from ensuring that players don’t create or duplicate any suit of armor, mace, spell, book, or item of value in the game. Rampant counterfeiting of any object leads to inflation and the gradual erosion of value — Peter Wayner, 2003

Thus, naturally, you a referee mechanism to police people from trying to spend the same banknote twice. Similar problems are currently solved on the internet with the use of a trusted party such as Facebook which won’t let two users use the same username or ICANN which won’t let two businesses claim the same domain name. All previous and failed attempts such as DigiCash, e-gold relied on using this very same model to keep track of who spent what, so is allowed to spend what, and who has what. Everyone quickly realised this was merely a reinvention of the wheel.

A lot of people automatically dismiss e-currency as a lost cause because of all the companies that failed since the 1990’s. I hope it’s obvious it was only the centrally controlled nature of those systems that doomed them. I think this is the first time we’re trying a decentralized, non-trust-based system. — Satoshi Nakamoto

The Uncheatable Heart of Bitcoin

Bitcoin is not an entirely original idea. It is, however, a novel amalgamation of several crucial ideas including RPoW, Blockchains, Public/Private key cryptography and Merkle Trees. Combined together, it allowed the formation of a peer network of competitive miners that acted as check and balance on one another, thus preventing people from inflating the money, fraudulently spending someone else's money or fraudulently spending money twice.

Using Proof-of-Work, Bitcoin is able to overcome the double-spend problem with no central authority. If a miner attempts to cheat and spend something twice or spend someone else's money, other miners will discover this when they review the new block and reject it. By doing so, anyone who would try and cheat the system is financially wounded. Anyone who has the infrastructure to even come close to doing so is incentivised to join in and profit by expanding the network.

Okay, so it is secure… Can we use it as money?

No! Anyone who has been in earshot of this ecosystem might have heard of something which is commonly termed the ‘Bitcoin scalability problem’ which suggests that because Bitcoin is limited to ~3tx/s, it is unable to function as an effective medium of exchange — and they would be correct: If you tried to run a business like Amazon on top of BTC you would cripple it immediately.

Currently on BTC which is the implementation of Bitcoin with the largest market cap, these blocks that I have explained to you which are hashed at head-spinning speeds in the name of the game, are limited to one megabyte.

Yes, one megabyte. Something early thumb drives could store 256 of. These blocks are discovered on average every 10 minutes, meaning you can roughly fit 2500 transactions on the network every 10 minutes, and supply and demand kick in well before that resulting in skyrocketing transaction fees just to send even the most minute amount of money.

For Bitcoin to work as money it needs to scale as money does. A single good shopping mall on the weekend will make more transactions than the network can possibly deal with.

This wasn’t meant to be the case.

Bitcoin is a great idea, perhaps one of the greatest of our time. It makes possible the ability to send secure, non-duplicable payments to others across the internet in real-time, but it is strangled by this 1MB limit. Counter to popular belief nowadays, Bitcoin was meant to scale beyond this, and it was designed to scale.

Today, an erroneous belief pervades the cryptocurrency industry in cryptocurrency which suggests that everyone needs to hold a full copy of the blockchain record to review it for their own purposes. The competitive forces between miners to fight each other for-profit is not enough — they argue. Instead, everyone must be able to download this record readily. This philosophy means that if the 1MB cap was to be lifted, people with low-end hardware would be excluded from downloading the full records as they would require enterprise hardware and bandwidth. Noble as this may be (I happen to think its a very destructive idea), Bitcoin was meant to do exactly what those who now manage it don’t want it to do.

The current system where every user is a network node is not the intended configuration for large scale. That would be like every Usenet user runs their own NNTP server. The design supports letting users just be users. The more burden it is to run a node, the fewer nodes there will be. Those few nodes will be big server farms. The rest will be client nodes that only do transactions and don’t generate. — Satoshi Nakamoto.

Adding to this, Satoshi further explained that the block size raised through a phase after a certain block height/time with some psuedocode:

if (blocknumber > 115000)

maxblocksize = largerlimit

So why was there a 1MB limit to begin with? As explained by one of the first community developers to work on Nakamotos first cut of the code, Ray Dillinger says that this was a security precaution to prevent the network from being overwhelmed in the early days. At such a small size, Nakamoto and Hal Finney agreed to temporarily limit the block size in case someone tried to flood the network with transactions and choke it up.

I’m the guy who went over the blockchain stuff in Satoshi’s first cut of the bitcoin code. Satoshi didn’t have a 1MB limit in it. The limit was originally Hal Finney’s idea. Both Satoshi and I objected that it wouldn’t scale at 1MB. Hal was concerned about a potential DoS attack though, and after discussion, Satoshi agreed. The 1MB limit was there by the time Bitcoin launched. But all 3 of us agreed that 1MB had to be temporary because it would never scale.

— Cryddit (Ray Dillinger).

In late 2010, Nakamoto left the project never to be seen again, leaving the project in the stewardship of talented developer Gavin Andresen. As per the design Nakamoto described, Gavin, attempted to proceed with scaling the network by proceeding with raising the cap through the fork BitcoinXT, which later evolved into Bitcoin Classic Significant disruptions occurred with heavy distributed denial of service attacks made on Bitcoin Classic network nodes by shadowy actors. These events later culminated in the hard forking network separation known as Bitcoin Cash.

Between all the mayhem, frenzied news from Australia broke loose with Craig Wright being named Satoshi Nakamoto by WIRED and Gizmodo following leaked private emails. This eventuated with Gavin Andresen personally meeting Wright in London, detailed in The Satoshi Affair where Wright signed a message of Gavins choosing on brand hardware he is convinced had not been tampered with one of the private keys only Satoshi Nakamoto could have held. Alarmed by the potential precipitous fall in power, the developer team managing the BTC code repository unilaterally ejected Andresen, the developer that Satoshi Nakamoto left to steward the project. Andresen has since left the public sphere and Bitcoin and Wright has sustained a long campaign of tacks on his family, character and credentials resulting in temporary retreat and many terming him to be ‘Faketoshi’ for refusing to sign publicly as he did for Andresen.

Fraud to the core.

Due to the economic stultification imposed by this capacity limit, Bitcoin has had little to no legal bid on the market for its use as cash. At best, it has since been treated like a hot potato to trade for US dollars, often because it can be easily used to trade for illicit material online or ransom payments required from crypto locker viruses. As there is very little steady and stable demand for Bitcoin and many exchanges online are rife with fraud, the Bitcoin price has schizophrenically traded up and down for many years with little bearing on reality. Deeper still, this has been goaded on by significant fraud involving cryptocurrency exchanges, leading to significant run-ups in price every 3 years from retail investors who slowly catch on to successful pump and dumps, tape painting and other price manipulation schemes.

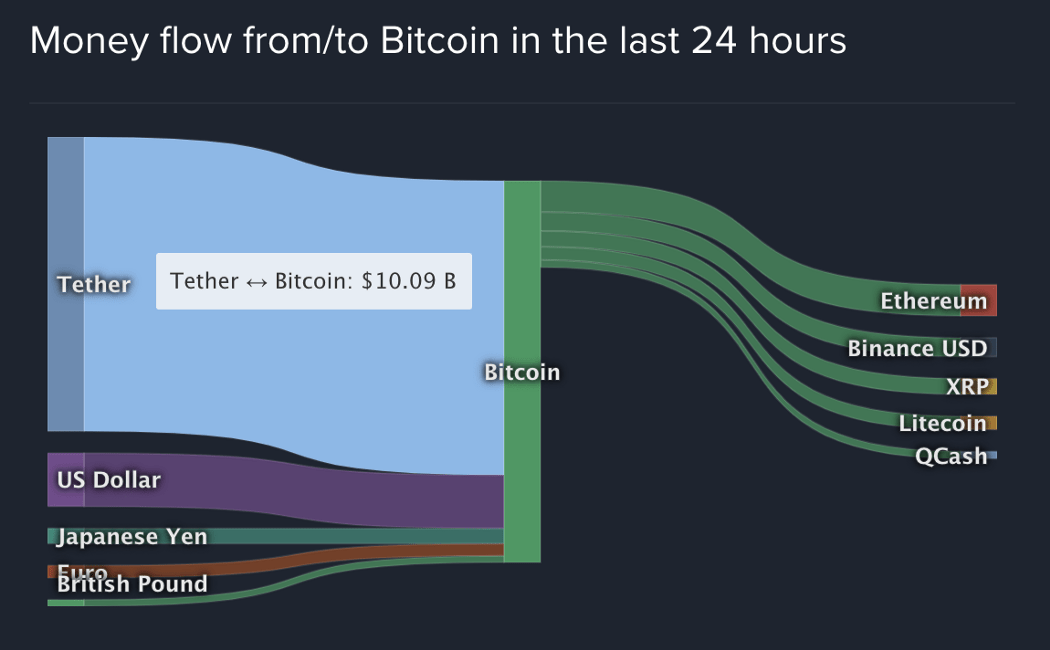

Chiefly behind the last couple of bull markets in Bitcoin has been a company incorporated as Tether Ltd/iFinix Ltd. They are the issuers of what is known in the crypto ecosystem as a “stablecoin”, which is a technical euphemism for a digital token which is allegedly backed by a dollar or euro so as to keep the price stable for trading in and out of cryptocurrencies. From humble beginnings, this project has turned into the majority of money flowing in and bidding up the price of BTC.

For anyone interested in the deeper nuts and bolts of this ongoing saga, I recommend reading the recently published article: The Bit Short: Inside Crypto’s Doomsday Machine.

You don’t purchase money, you earn money.

Confused narratives surrounding Bitcoin and Ethereum have unsurprisingly lead to some significant purchase from retail investors looking to get in on the action prompted by these manipulations. Does this sound birth a new monetary system to you? Most of us, under any other circumstance, hate purchasing foreign currencies. Whether it is getting pilfered at a foreign exchange desk at an airport or robbed by conversion rates over the MasterCard and VISA networks, buying new currencies is troublesome, expensive and generally a pain in the ass.

Due to the general lack of things to do with a Bitcoin or a Ether, you will find that most people who buy these tokens hold (see: HODL) and do very little with them, hoping that one day they will be able to trade them back into fiat money at extraordinary rates. The more precocious and starry-eyed anarchists hope that they never have to trade them back into fiat currencies, hoping that like software, cryptocurrency will eat the world and they will be able to offload their DOGE, SUSHI for retail goods themselves, replacing the United States Dollar or European Euro.

For reasonable people, however, money is something that is something you earn. Money is a wonderful good which trades against every saleable good in the economy, showing us what the exchange rate between dollars and rice is, dollars and computer parts, dollars and electricity. No one can say BTC with its volatile price is useful for this, nor ETH, XRM, XRP, etc. Prices tell us a lot, they are merely organic rationing systems which show the relative scarcity of goods and services in the economy. With stable prices, we can learn a lot about the world. The artificial restrictions imposed on BTC however, prevent an online earning economy from properly forming. Often, because of the restriction on space in blocks, significant fees are required to even get your transaction validated by the network. If I would like to complete small online jobs for a fee, $5/tx fess make the situation entirely uneconomical.

Retreat to the margin of safety

At present, no earning and spending economy exists on Bitcoin or Ethereum or any of the myriad of other tokens for sale to retail investors. Things which have no actual utility unto themselves eventually get prices reflecting their utility following the undoing of exuberance and manipulations: zero.

For the curious, however, a flurry of new applications is now being developed on a new unrestricted implemented version of Bitcoin called Bitcoin SV (Satoshi Vision) headed by a newly emboldened Craig Wright. With fees at a fraction of a cent due to the large capacity, video makers on Streamanity are able to monetise each view of their video and microbloggers are able to monetise their snippets on Twetch instead of giving their content away for free on Twitter.

Benjamin Graham suggests that a margin of safety should be found when evaluating any stock. When even the most studious BTC investor is honest with themselves, they know that BTC has no margin of safety. Gold can’t go to zero because gold has applications. People need gold to complete electronic goods, make nice earings and provide good density. It can be reasonably assured that at least one person will always be willing to buy your gold off you, regardless of the ebbing conditions of the market.

Anyone investing in cryptocurrency should consider these assets on the same grounds. Will anyone actually need this in 10 years? If the answer is no, or you can’t even answer that question then you probably shouldn’t be buying money.

Conclusion

The idea central to Bitcoin is not that you don’t need a referee, it is that you need a competitive system for referees. It is “can’t be evil” rather than “don’t be evil.”

Right now, this vision is unrealised in BTC, the version of Bitcoin most people think of as being the real thing, and with a dominance that looms as 61% of the market as of writing, this affects the entire market and many of the alternative coins which are built on the same fallacies. This original vision of Bitcoin unrealised in other cryptocurrencies with the Ethereum Foundation’s ability to unilaterally fork the chain and Monero’s regular forking schedule introducing increasingly quirky consensus algorithms for the creation of botnets.

A system is only decentralised when the rules cannot be changed by a single authority. This vision currently lives on in the quiet but strengthening backwater of Bitcoin SV.