Key Takeaways

- Crypto trading bots can automate trading strategies and save time for traders, with popular types including arbitrage, trend trading, and market maker bots.

- Bybit and KuCoin are among the top 6 crypto trading bots that offer excellent features, ease of use, and functionality, but each has its drawbacks.

- Other notable trading bots include Bitsgap, Pionex, Shrimpy, and Cryptohopper, each with unique features and capabilities suitable for different types of traders.

- It is possible to make your own crypto trading bot and tailor it to your needs, using open-source bots as a basis or building from scratch.

- Key steps to creating a decent trading bot include deciding on a programming language, finding developers, finding APIs, deciding on a bot trading model, paying attention to bot architecture, development, and testing.

Since crypto has become more popular in the last few years, more people are turning towards cryptocurrency trading as a means of making money. Some have turned to crypto trading bots to automate their strategies, taking the emotion out of trading, and saving valuable time.

Let's learn a little about trading bots, before you try to build one for yourself. If you just want to jump straight into making your own bot, click here.

The Types of Crypto Trading Bots

A crypto trading bot is an automated software that buys and sells assets according to predefined rules. You can buy these bots from companies that develop them, or you can make them using open-source software. The three basic and most popular types of trading bots include arbitrage, trend trading, and market maker bots.

Arbitrage Bots

Arbitrage bots work by analyzing and comparing price differences between various exchanges. For example, let’s say that BTC is on a certain exchange trading at a lower price than another exchange. The bot will automatically buy the BTC at a lower price and sell it on the exchange where it has a higher trading price to generate profit.

Trend Trading Bots

Trend trading bots continually follow trends in the market to take advantage of them and generate income. For example, if the value of BTC increases, this bot will place a buy order. If the price of BTC drops, it will place a sell order.

Market Maker Bots

Finally, there are market maker bots, which are the simplest. Their function is to simultaneously place buy and sell orders to generate profit from the bid-ask spread.

Functionalities Offered by Trading Bots

There are different trading bots that different development companies sell. No matter which bot you choose, or what type of bot you want to make, there are a few essential functionalities that you should pay attention to.

Notification System

A notification system that most trading bots offer can be very useful in many situations. It is always good to be alerted when a trade is made, or when a certain number of trades are achieved. Many bots also have the option to get notifications via email, push messages, and similar. Consider making a good notification system when making a trading bot.

Automated Dynamic Changes in Strategy

It can be very useful to let your bot use automated strategies. These can range from very simple, like buying a fixed amount of assets at certain intervals, to complex ones based on different dynamic technical indicators. Simply create a strategy and let your bot apply it on a regular basis, so you can simply sit back and earn passive income.

History and Market Tracking

To be successful in crypto trading, you need to pay a lot of attention to the history of various assets, and constantly analyze changes in the market. However, instead of spending hours brainstorming, you can simply let your trading bot do the job for you and apply the best possible strategy for generating as much income as possible.

Performing Backtesting

Backtesting can be a very useful process when trading crypto. It involves testing a trading strategy on historical data to see how accurate it can be. The best thing is, you can let your bot do all the necessary backtesting before performing a trade.

Transaction Data: Registration, Retrieval, and Archiving

Trading bots allow you to have all your transaction data saved on the server. It can be useful to analyze transactions that you have performed in the past, so you can have more information on what to do next. On the other hand, you might simply want to have your transactions saved so that you can analyze your income history in your free time.

Security Features

When trading crypto, security is the number one concern of most traders. Obviously, security can make a huge difference between making a bot and buying one. When you buy a trading bot, you can rest assured that maximum security is guaranteed. On the other hand, you will need to be careful about security when making a trading bot on your own.

Scheduler

A great thing about trading bots is that you can schedule them to perform certain actions at specific dates and times. For example, let’s say that you need to perform certain actions on specific days during the way. You can simply schedule your bot to do it, so you don’t have to be tied to your computer or mobile app that those specific times.

Top 6 Crypto Trading Bots

Before making your own trading bot, it is good to check out the best trading bots available on the market. We have tested a wide array of trading bots and will present you with our TOP picks in terms of price, functionality, ease of use, and other essential factors.

1. Bybit

Bybit trading bot is one of the most well-designed and functional trading bots in the market, which is also very intuitive and easy to use. It offers a clean interface and is suitable for both entry-level and advanced traders. Entry-level users can take advantage of its automated AI Strategy parameters, which only require you to input the contract pair and the amount you want to invest.

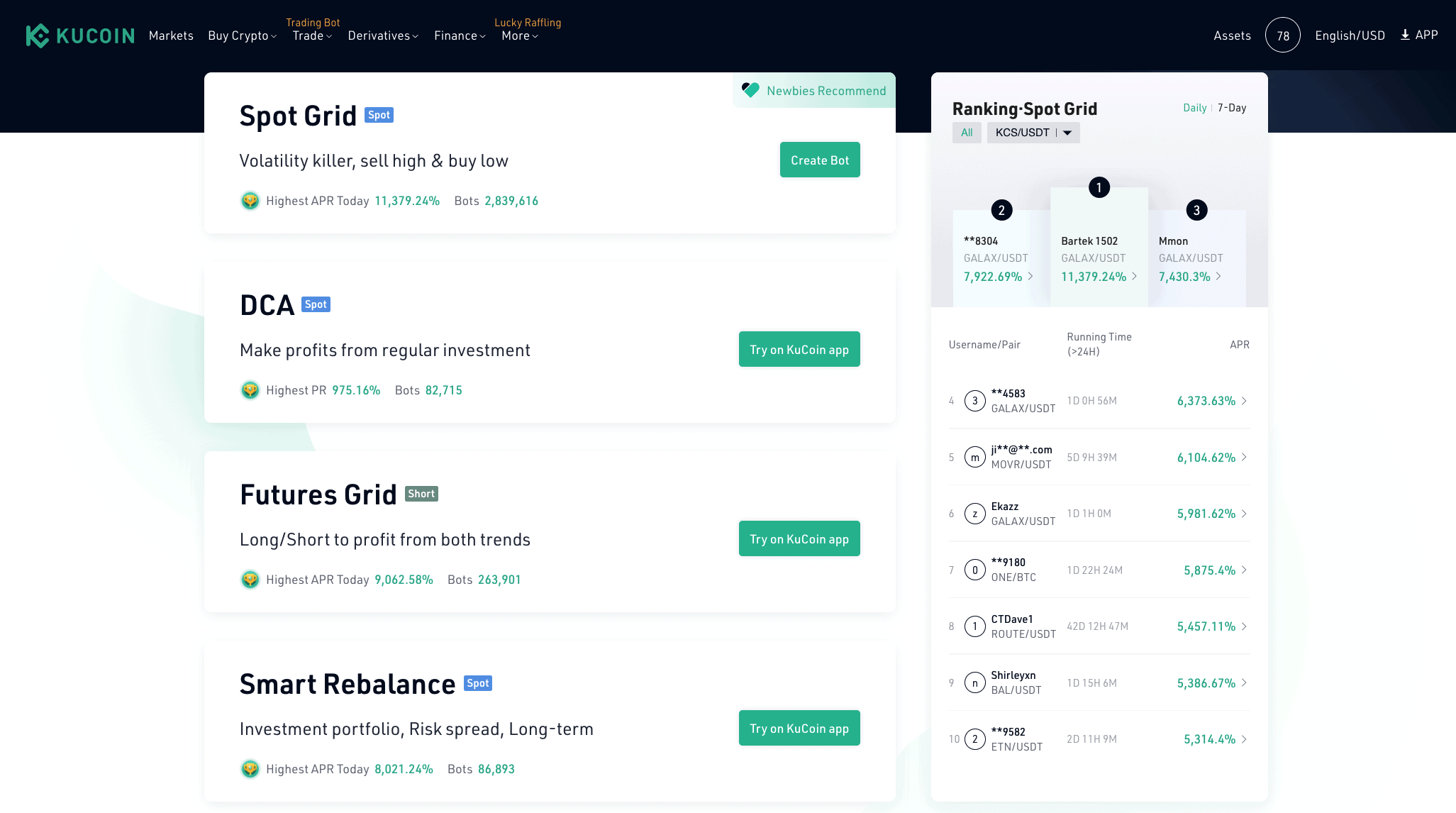

2. KuCoin

KuCoin is a popular crypto exchange platform that also has its own trading bot. The bot supports all major trading pairs and is excellent for beginners, but has two major drawbacks. First, you can only use the bot on the KuCoin exchange platform. Besides, you will need to install a mobile application, since the bot is only available through the mobile interface.

3. Bitsgap

Powered by the GRID algorithm, the Bitsgap trading bot allows you to define the range and limits for investments, which will then be distributed proportionally. Every time the bot executes a limit order, it will place another sell order for a slightly higher price than the market value.

4. Pionex

Pionex is a crypto exchange network that comes with 16 different trading bots, suitable for both beginners and advanced traders. Its most popular bot, Grid Trading Bot, can help you sell high and buy low. It is also easy to use and comes with a clean and intuitive interface.

5. Shrimpy

The Shrimpy trading bot is excellent for social and copy trading. It allows you to track portfolios across different exchanges, and you can easily manage and trade assets across over 15 exchanges. However, note that Shrimpy is web-only and has no mobile support.

6. Cryptohopper

Cryptohopper is a trading bot that is based on the cloud principle and allows users to use analyze different factors to make ideal trades in different situations. You can use Cryptohopper on 9 different exchanges, including KuCoin, Coinbase, and Binance. In addition to BTC, you can use Cryptohopper to trade over 75 different assets.

Building Your Own Crypto Trading Bot

You can’t make a mistake by choosing any trading bot from our list, since these are the best bots currently available. However, if you want to make your own bot that is more suitable for your needs, we will help you understand everything that you need to know.

Using Open-Source Bots as a Basis

There are multiple ways to make a trading bot, but the simplest and cheapest is to find and download open-source crypto. That way, you can make a trading bot with the minimum technical knowledge and development time. However, to build your own features and fix any possible bugs and security issues, you will need to hire an expert software programmer.

The good thing about making your own bot is that you can implement unique features that suit your needs and trading style. You can find different open-source crypto bots online, but the most popular ones are Gekko and Zenbot.

Zenbot

Zenbot is an AI crypto trading algorithm that is able to perform high-frequency trading and do extensive market analysis. Its open-source code is available for free and can be modified to your needs. However, Zenbot is compatible only with some exchanges and updates are very rare. Also, developers state that if you use it for large sums, you use it at your own risk.

Gekko

Like Zenbot, Gekko is also a free open-source trading bot, but it’s not easy to use and is not ideal for beginners. Also, Gekko is based on Javascript, which means that it operates from users’ machines. It is not a web or a cloud-based program. However, note that there is no customer support team, which means that all the answers you might need may only be available on forums.

Building from Scratch

What about if you want to build your trading bot completely from scratch? It can be financially rewarding if you can build it successfully, and will also save you time. The most essential part is to have a passionate and dedicated team by your side, but you will also need skills and experience.

You can build the most basic trading bot in a matter of weeks. Obviously, if you want to build a more advanced bot that can trade on multiple exchanges and have advanced features, it will naturally take you more time. You will also need more time to ensure that using your trading bot is completely safe and secure.

Key Steps to Creating a Decent Trading Bot

Creating a trading bot involves a decent amount of work. However, if you do the key steps the right way, you can significantly reduce the production time and make the bot safer and more reliable. Let’s see what are the key steps to creating a decent trading bot.

1. Deciding on a Programming Language

It’s a good idea to work with a programming language that you are familiar with. The most common languages used for creating crypto trading bots are Python, Javascript, Perl, and C. Since these are very popular, you can easily bring in other developers to help you out. Also, there are a lot of tutorials online that can be very helpful in the learning process, in case you haven’t used one of these programming languages before.

2. Find Developer(s) to Work with

Before you begin working on the bot, it can be very helpful to find developers that have experience with the programming language you intend to use. If you don’t want to work on the bot personally, you can also hire a professional development team to do the hard work for you. An experienced development team will do the job much faster, and will also guarantee top safety when your trading bot is handling large sums of your or your client’s money.

3. Finding All the APIs You Need

Note that a trading bot will need to somehow connect to a certain exchange platform, and to do that, you will need to find the right APIs. These are used during the coding phase to allow the bot to communicate with the trading platform. The good thing is, all of the major trading platforms already have APIs that you can download and use for free. Most APIs are also very simple and come with an easy-to-understand manual.

4. Decide on a Bot Trading Model

We already mentioned trading models at the beginning of the article. Obviously, before you start working on the bot, you will need to decide which kind of trading the bot should perform. However, keep in mind that the more complex trading models will require more time spent coding.

5. Bot Architecture

When programming a trading bot, it is essential to pay attention to the architecture. The mathematical model it is based on should be solid, or at some point in the future, the bot will prove to be unreliable or will lose your money. Basically, the architecture and algorithm of your bot should be as simple as possible, as long as it does the job properly.

It is important to define what kind of data you want your program to interpret. For advanced trading models, your program needs to be able to identify things like inefficiencies in the market. The bot should also be able to analyze historical trends, so if the architecture is unclear and complicated, it will definitely lead to malfunction at some point in the future.

6. Development

Once you have defined and outlined the architecture for your bot, it is time to start developing. Obviously, this will be the most time-consuming part of the whole process. In case you have gathered a team, it is essential to have good management and communication. A nice idea is to start a group chat on a program like Slack, where team members can talk to one another. It is also useful to hold weekly meetings to ensure that every member is going in the right direction and knows what he is doing. That way, you can solve together any potential problems that might have occurred.

7. Testing Phase

The testing phase is important for two reasons. First, it will ensure that your bot is working properly and is able to handle all kinds of data fluctuations that will be thrown at it. Besides, testing is great for fine-tuning the way the bot works.

8. Deploying the Bot

Once the bot is created and fine-tuned, it is time to let it loose on the market. You might naturally start dreaming of making instant fortunes, but remember that no platform in history has ever made a significant success without some problems down the road.

You should also keep in mind that a trading bot is an evolutionary thing. The more time you invest in development and tuning, the better and more efficient trading bot you will get. We strongly recommend you constantly monitor your bot’s performance, at least in the first few months. After that, your bot should be able to earn you passive income without much of your supervision.

Key Factors for Successful Development

To make sure that you successfully develop a trading bot, there are a few factors you should consider. These will save you from a lot of potential problems down the road.

1. Development Tools

When creating a trading bot, you need a crystal-clear development approach. First, you should identify the appropriate technology to use and the appropriate cloud platform. Then, you should choose the right set of open-source tools and formulate the right bot security solutions. Finally, you should decide on which testing and DevOps tools to use.

2. Project Planning

To make sure you make a successful trading bot and to prevent wasting your time, you should have effective planning. First, you will need to choose the right SDLC technology and create an effective project schedule. You should also plan important factors, such as the management of risk, communications, and similar.

Then, you should start hiring the right developers and do all the necessary metrics and measurements. Note that stakeholder management is also an essential part of project planning.

3. Hiring the Right Team

Hiring the right people is important in any project related to creating software, and the same applies to making a trading bot. The first and most important thing to do is to find the right platform. You might want to hire developers from a freelancing platform, but it can have certain drawbacks. For example, managing such a project with part-time developers can be difficult, and there is a big chance that you will need to find replacement developers at some point.

When having such a complex project, it might be ideal to hire a software development company. These provide full-time developers and will also provide a replacement if the original developers leave the company in the middle of the project.

Good developers should have certain skills. They should have expert knowledge in programming languages like Python and Javascript, and a good knowledge of relevant tools and frameworks. It is also ideal if they have experience with developing scalable applications and knowledge of RESTful API development.

A Point About Market Volatility

A crypto trading market is extremely volatile. Multiple times during the past decade, the value of Bitcoin has dropped by 25% in a day. If you plan to work long-term, you might not worry about those huge fluctuations. It is also a good thing that crypto traders can make a fortune if using those fluctuations to their advantage.

Trading bots are the solution to this issue. These have been used for decades to buy and sell fiat and crypto on global exchange platforms. By automating the trading process, trading bots play a huge role in relieving the pressure on traders and even companies.

Conclusion

As you can see, trading bots can be extremely useful. Not only does a trading bot save you time, but it also analyzes different factors, such as the history of the market, saving you from hard work. There are plenty of great trading bots that will automate the process of profiting from crypto. However, if you want a trading bot that is perfectly suited for you, the only solution is to make your own. We are sure the steps above will help you on your journey.

Frequently Asked Questions

A crypto trading bot is software that allows you to put your crypto trading on autopilot. While the simplest bots only buy and sell assets according to predefined rules, advanced bots will use artificial intelligence to improve trades and increase profit.

Using your own crypto trading bot can be risky if you haven’t tested it properly before deployment. Make sure that everything is working correctly before letting your trading bot trade on the market. This ensures maximum security and prevents you from losing money due to programming errors.

FAQs

What is a crypto trading bot?

A crypto trading bot is a software that allows you to put your crypto trading on autopilot. While the simplest bots only buy and sell assets according to predefined rules, advanced bots will use artificial intelligence to improve trades and increase profit.

Are custom crypto trading bots risky?

Using your own crypto trading bot can be risky if you haven’t tested it properly before deployment. Make sure that everything is fine before letting your trading bot loose on the market to ensure maximum security and prevent losing money.