Key Takeaways

- Market orders are the easiest way to trade - you do not choose a price to trade at, but instead take the current market price.

- With limit orders you can select the exact price that you wish to trade at.

- Stop orders are not placed immediately, but rather when a trigger price is reached.

- Stop orders can be limit orders or market orders

- Stop loss is a type of stop order where you place a trigger lower than the current price. If the trigger is reached, a sell order is placed to minimize your losses from continually falling prices.

- Take profit orders are another type of stop order. You place a trigger higher than the current price, and it automatically places a sell order when the trigger is reached, to lock in your profits before the price falls.

It's time to look at the different types of cryptocurrency orders you can make when you are trading. Market orders, limit orders, and stop orders all have their own uses, advantages, and disadvantages. Let's see how they differ, and learn which type of order is best to use for each situation..

Market Orders

The first type we will cover is the simplest one for trading, known as a market order. This is when you decide on the amount that you wish to trade, but you don't choose the price that you are paying; instead you take the best price available. If you are looking to buy, then the best price for you is the lowest ask price, also known as the best offer. If you are looking to sell, then the best price is the best bid (or the highest buying price).

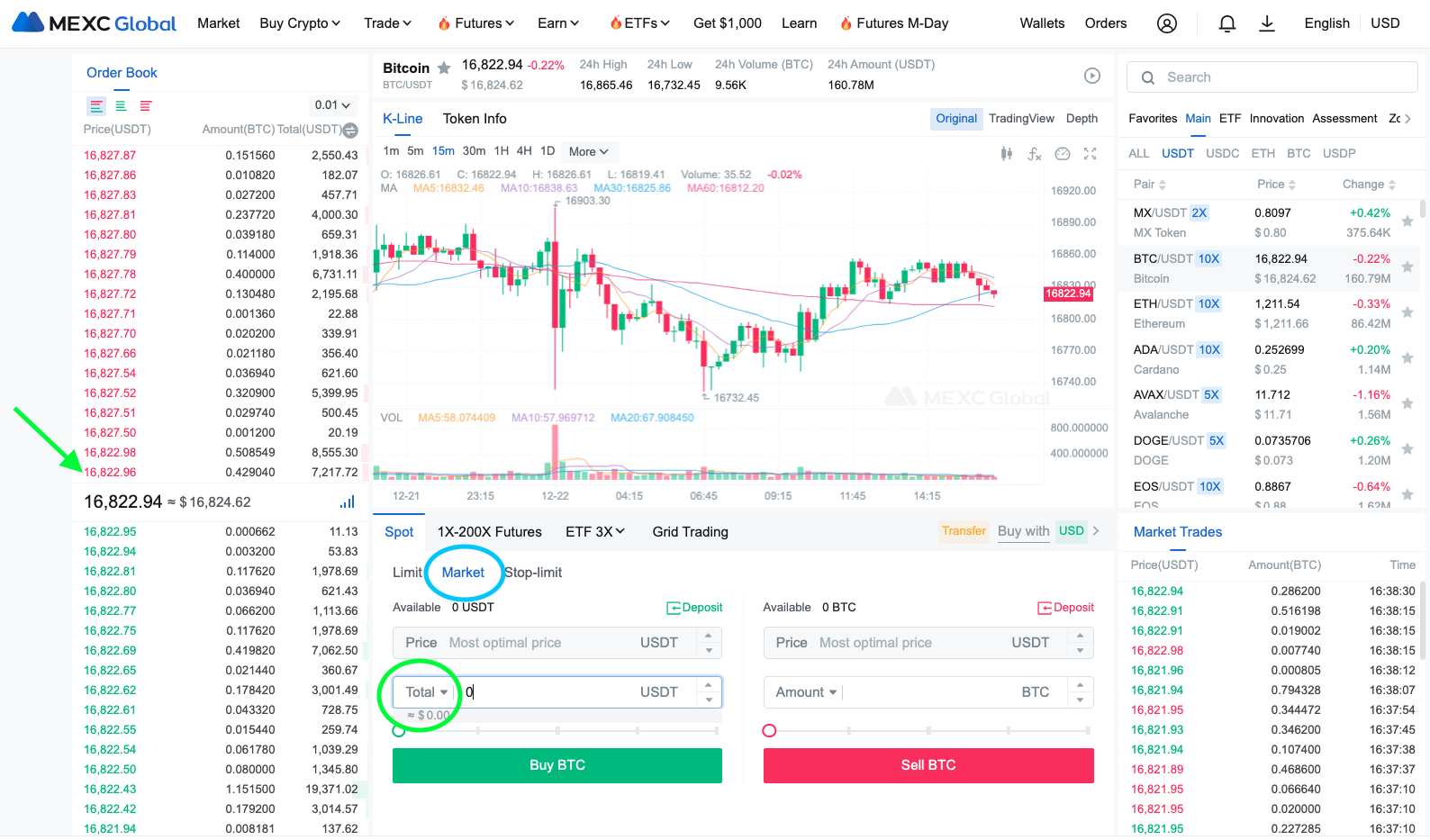

Let's pretend to create a market order, using BTC/USDT trading pair as an example. Navigate to the BTC/USDT trading pair page on MEXC. If you have forgotten how to do this, go back to lesson 4 and follow the instructions there.

On the trading page, the default order type on MEXC is limit order (which we will cover next), so to place a market order, click on the word 'Market' (circled in blue in the screenshot below). In this example, we will place a market order to BUY Bitcoin. So we use the left side of the order form, above the green 'Buy BTC' button. Type in the amount of USDT you wish to spend, for example $1,000 worth of Bitcoin. If you prefer to buy a certain amount of Bitcoin, let's say you wish to buy 0.25 BTC, then click on the word 'Total' (circled in green below) and change it to 'Amount'. This changes it from USDT to BTC, and you can type in 0.25.

When you are ready to place your buy order, click on the green 'Buy BTC' button, and your order will be immediately fulfilled at the best available price. Since you are buying BTC, the price you receive is the lowest ask price, otherwise known as the best offer. This is the lowest number in the list of red sellers. In this example, the price you bought Bitcoin for is 16,822.96 (as shown by green arrow above).

You need to be aware that depending on the size of your order, the price that you pay may not be completely fulfilled at the lowest ask price. If we look back at the screenshot above, take a look at the Total (USDT) column next to the best offer price of 16,822.96. You can see that the total amount is 7,217.72 USDT. If you placed an order that is larger than that amount, you would buy up all the Bitcoin that seller is offering. For example, if you purchased 10,000 USDT worth of BTC, you would buy all of the Bitcoin that seller is offering at 16,822.96, and to fulfil the rest of your order, the remaining 2782.28 USDT worth of Bitcoin would be at the next lowest price, of 16,822.98.

When you trade by placing market orders, you are known as a 'market taker' because you are taking orders from the order book. This is useful to know because many crypto exchanges charge a slightly higher fee for takers as opposed to makers. A market maker is someone who places a limit order, which adds to the order book. The reason crypto exchanges incentivize market makers is because they increase liquidity and make it easier for others to trade. At MEXC, the spot trading fees for takers is 0.2% (but you can reduce this by 10% if you sign up with our link). For market makers, MEXC has removed spot trading fees, so it is free to trade using limit orders!

Before we move on to limit orders, where you can trade for free, let's have a quick look at the Pros and Cons of placing market orders.

- Easiest way to trade cryptocurrencies

- Order will be fulfilled immediately

- No need to keep checking whether your trade was executed

- Can trade larger amounts of crypto without any trouble

- Can easily trade cryptocurrency pairs with lower liquidity

- You can end up paying too much for your crypto, as price jumps happen quickly due to market volatility

- If you place a large order, you could move the price and pay more than you expected

- You are on the wrong side of the spread so you're immediately at a loss

Limit Orders

The next order type we will cover is the limit order. This is when you set the exact price that you wish for your trade to be executed. Let's say you want to buy Bitcoin with USDT, and the current price is 16,615.57, as per the order book here.

If you want to buy Bitcoin quickly, you can create a limit order around the same price, to ensure the order is fulfilled. If you set your price at 16,615.50, there is a good chance that your buy order will be met.

However, if you are watching the graphs and the price of Bitcoin is falling, you may want to se your limit order at a lower price, in order to get a better price on your Bitcoin. For example, you can set your limit order at 16,550, or 16,500 if you think it might drop to that price before it increases in price.

Another option is to place a limit order at a much lower price. This is useful for traders who believe the coin is currently overvalued. For example, let's say you believe that the current price of Bitcoin at 16,515.57 is too expensive. You want to buy Bitcoin, but only if it drops down to 12,000.

You can set a limit order at 12,000, and let it sit there. If the price never drops down to 12,000 your limit order won't be filled, and you won't have Bitcoin, but you are not worried about that. You only want to buy Bitcoin if it drops down to 12,000 as you think that is a good price to pay for it. Your limit order can sit for weeks or months, until it is filled.

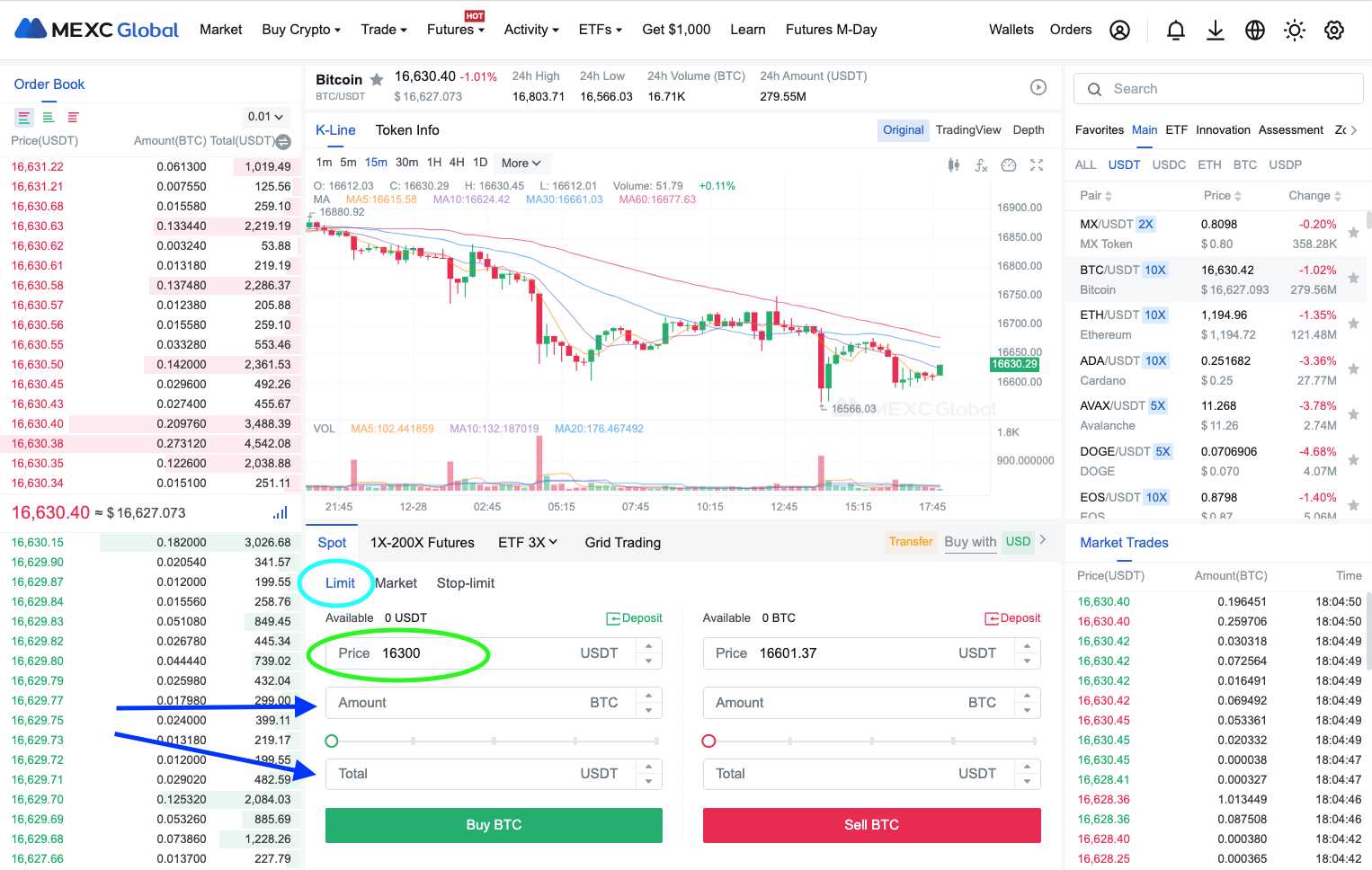

We will have a look at how to place a limit order, again using BTC/USDT trading pair as an example. In your MEXC account, navigate to the BTC/USDT trading pair, then click on 'Limit' as shown below (circled in blue). In the example below, the current price of Bitcoin is 16,630.40, but we will set a limit order at the price 16,300 as the market appears to be falling. Enter the price that you would like to set your limit order at, in the box titled 'Price' (see green circle below).

Now you can select the amount of BTC that you want to buy, or the total amount in USDT. For example, you may want to buy 0.25 BTC, at the price of 16,300 per BTC. Alternatively, you may choose to buy 2,000 USDT worth of Bitcoin, at the price of 16,300 per BTC. Once you have selected the amount, click the green 'Buy BTC' button below.

After you place a limit order, it will appear underneath, under the section titled 'Open Orders', until it is fulfilled. If you place a large order, note that your whole order may not be filled at once. For example, let's say you want to buy $10,000 of Bitcoin at 16,300 per BTC. As the market moves, you may get a seller that sells you $1,000 of Bitcoin, and another seller that sells you $500 of Bitcoin. After that, the market may turn as more buyers flood in. Due to the increased demand in Bitcoin, the price is pushed up past your limit order of 16,300, and the rest of your order remains unfulfilled.

One great thing about placing limit orders, is that you are adding to the order book, meaning you are a 'market maker'. Cryptocurrency exchanges like market makers because they increase liquidity, making it easier for others to trade. This is why they reward makers with lower fees. On MEXC, it is FREE to trade as a market maker, so you should take advantage of this by placing limit orders when it is feasible. Here is a summary of the Pros and Cons of trading with limit orders.

- You can choose the exact price of your trade

- You will never pay more than you expect to pay

- 0% fees when trading on MEXC

- Avoid slippage when trading large amounts

- You have to wait for someone to take your trade

- Order may not be fulfilled immediately, or at all

- If you place a large order, part of the order may remain unfilled

Stop Orders

A stop order is a different type of order; it is not placed immediately, but is triggered when a certain price is reached. You can place stop-market orders and stop-limit orders.

Stop-market Order

A stop-market order will place a market order when your trigger price is reached. For example, if the current price of Bitcoin is 16,500, and you want to place a market order to sell Bitcoin if the price reaches 17,000, you would set your trigger price at 17,000. Remember, this does not mean that you will sell your Bitcoin at exactly 17,000. Once the price hits 17,000 (your trigger), a market order is placed, meaning that you will sell at the best price available to meet your entire sale amount. Remember that the market is continually fluctuating, with buyers and sellers coming in all the time. Also, if the amount of BTC you are selling is substantial, it can cause the price to fall when using a market order.

Stop-limit order

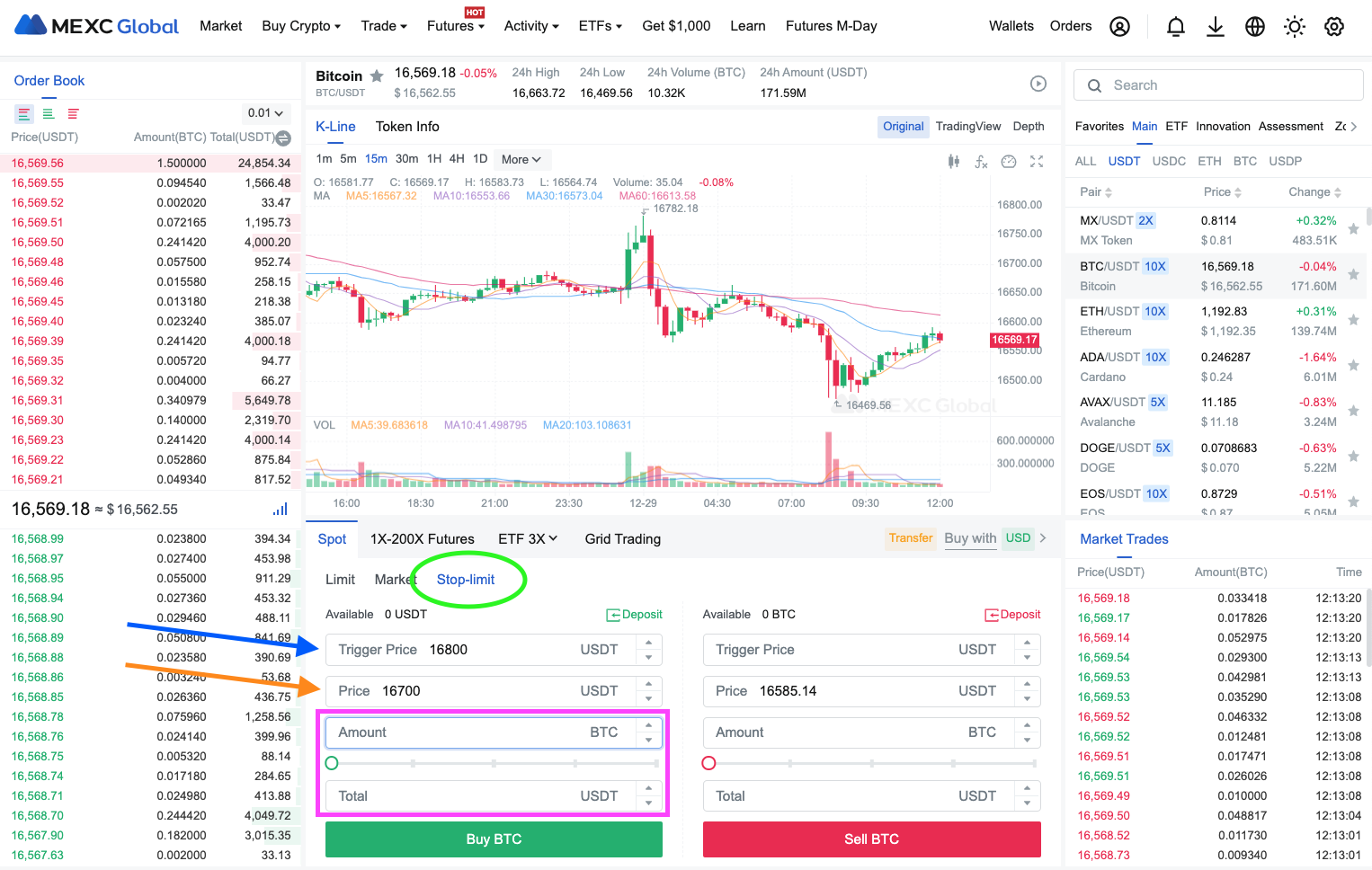

A stop-limit order will place a limit order when your trigger price is reached. You can choose what price you want to make your trade at, just like a normal limit order. Let's say the price of Bitcoin has been hovering around 16,500, and from your analysis, if the price reaches 16,800, it will likely break out and continue going up. You might want to buy Bitcoin if the price hits 16,800, to take advantage of a quick rise in price, so you set 16,800 as your trigger. However, you also know that crypto prices usually fluctuate even when the trend is going in a particular direction. So when the trigger price of 16,800 is hit, instead of setting a limit order at 16,800, you might want to place a limit order for 16,700 to get a better price on your Bitcoin. I'll show you how you would place this order on MEXC.

We will use the BTC/USDT trading pair as our example again. Click on 'Stop-limit' (circled in green below) and you will see there are two sides, one for Buy BTC and one for Sell BTC. Since we want to buy BTC, we will use the left side. We want to set our trigger price at 16,800, so type that into the box (shown by blue arrow). Then we want to set our limit price, which is 16,700, which is shown by the orange arrow. Underneath, you can select either the amount of BTC you wish to buy, or the total amount of USDT you wish to spend (pink rectangle). Once you are happy with that, click the green 'Buy BTC' button. Remember, this does not buy BTC straight away, nor does it place your limit order immediately. The limit order will only be placed if the price of BTC reaches 16,800 (your trigger price).

Stop Loss Order

If you have done some research into crypto trading, you may have heard about stop losses. A 'stop loss order' is a version of a stop order (either stop-limit or stop-market) where it stops your losses. They are a crucial tool if you are a day trader, to prevent you from losing too much money. The way a stop loss order works, is that you set a price that is below the current trading price. If that price is triggered, a sell order is automatically placed (either limit or market order) so that you do not lose more money as the price continues to fall.

For example, say you buy Bitcoin at the current price of 16,500, hoping to sell it once the price reaches 17,000. However, you need to consider the risk of the price dropping instead of rising. You may choose to set a stop loss at 16,200, so you limit the amount of money you lose.

Take Profit Order

A 'take profit order' is another version of a stop order, which is basically the opposite of a stop loss. While a stop loss order is used to cut your losses, a take profit order is used to lock in your profits. Continuing from the example above, we have bought Bitcoin at the current price of 16,500, and we want to sell it once the price reaches 17,000. To do this automatically, you set a take profit order (which is a stop order) to trigger at 17,000. Once the price is reached, a sell order is automatically placed (either limit or market order) so that you can consolidate your profits before the price falls back down.

Before we complete this lesson, let's summarize the Pros and Cons of using Stop Orders.

- Great when fast trading for buy/sell breakouts

- Limit your losses and secure your profits automatically

- Excellent tool when trading using technical analysis

- Can use stop orders to buy or sell

- Can place limit or market stop orders

- Your orders may not execute if the trigger is never reached

- When your take profit order triggers you could miss out on potential larger gains